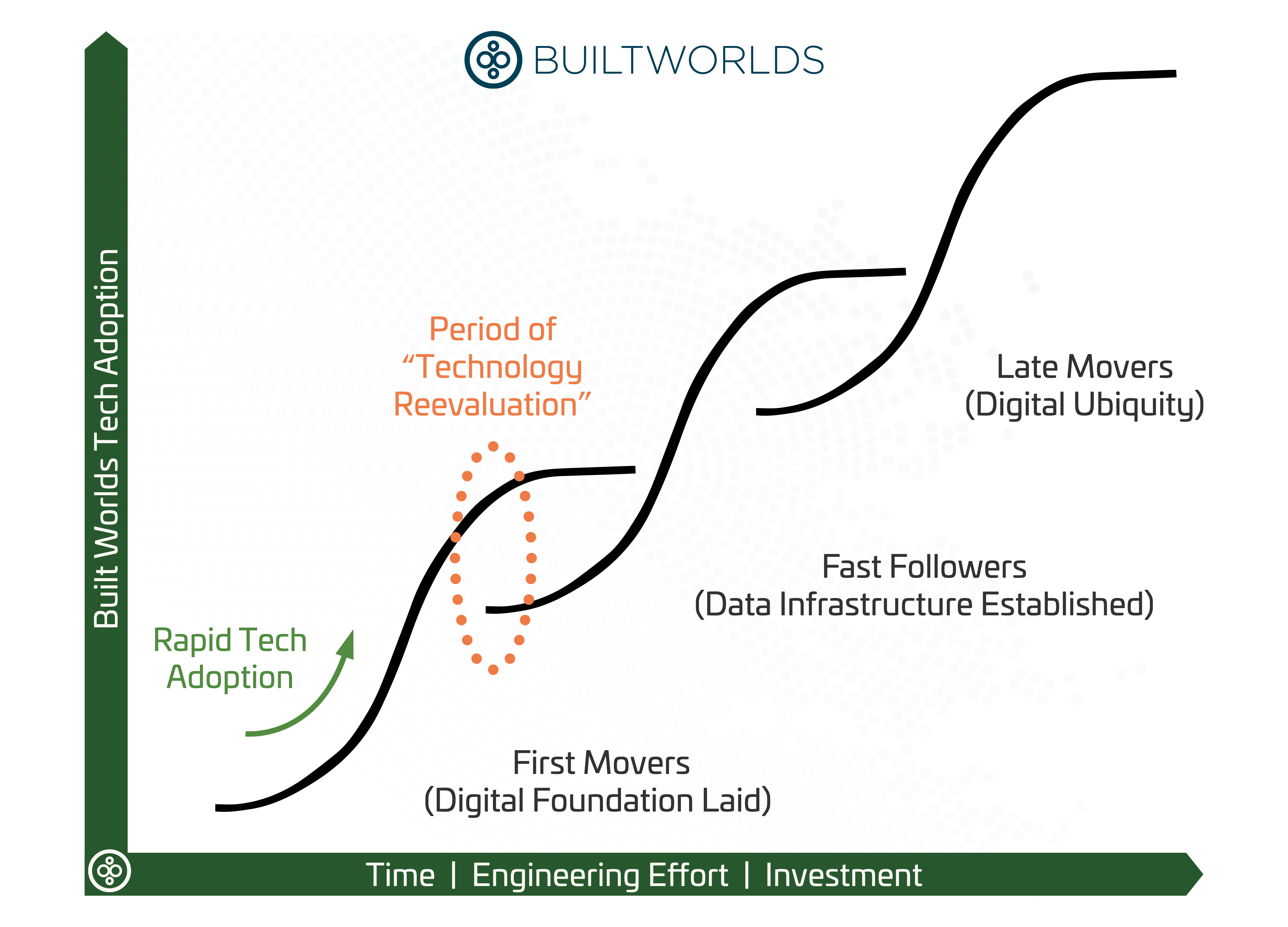

Following recent discussions around BuiltWorld's article: Is Construction Tech Approaching An Adoption Ceiling? the Venture & Investment team decided to analyze the path of the built world's digital transformation. What we discovered were anecdotes from other sectors' innovation cycles, which all had one thing in common: they were iterative. The way up and to the right is never a straight line and transitory hurdles always arise. Assessments of recent discourse around decelerating adoption in song with patterns seen from more mature innovative niches, it would appear the built world is in a period of "technology reevaluation".

The Concern

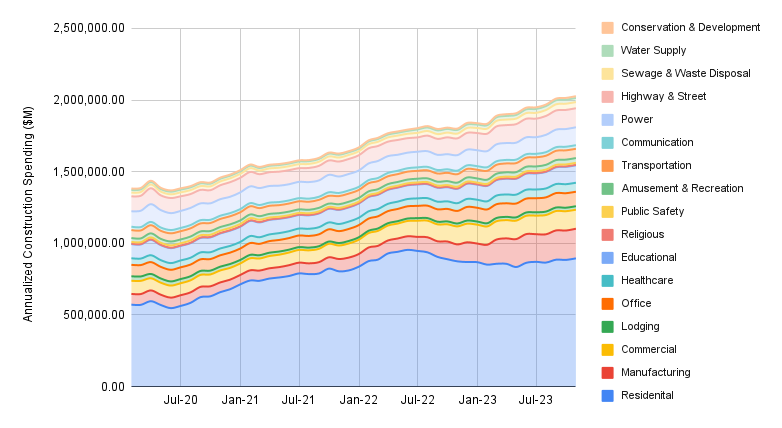

The ConTech space is not entirely immune to macro headwinds. The economically agnostic strength in the AEC sector is undeniable with US Construction Spending breaching $2T for the first time in August (following the US Census’s annualized October revisions) and has now hit consecutive all-time highs for 9 months (see chart below).

Still, many construction firms are tightening their pursestrings, implementing more selective approaches to new solutions, and cutting back on vendors that don’t provide an immediate correlation to value/revenue.

The ConTech adoption curve is positioned as an S-shaped curve, a widely accepted idea, but what isn’t being as widely discussed is the notion that the end of one rapid expansion cycle marks the beginning of another (shown on the S-curve graphic above).

Period of Technology Reevaluation

This industry just went through a period of rapid tech adoption in the wake of the global lockdown’s digital accelerant.

Liberal investments into tech stacks in the hopes of optimizing operations and aligning disparate stakeholders have found leading-edge AEC companies overwhelmed. Now corporate captains of construction are reassessing; cutting back on solutions that don’t produce easily quantifiable value or materially reduce the number of steps to complete a task (roughly defined as 5 or more steps).

The swelling number of siloed point solutions that some Project Managers and Superintendents have to manage on each project can be inundating. In some cases, where tech stacks aren’t properly integrated, each new solution may be incrementally adding tasks to an AEC group's daily responsibilities.

The Procore Platform, Autodesk’s Construction Cloud, and other recently developed platform approaches are a step in the right direction to unsiloe stakeholders and their data across the value chain. However, these SaaS platforms remain in their infancy and have largely only targeted the largest AEC corporates (indicated by the reported costs associated with Procore & Autodesk’s solutions). These platforms are still building out their functionalities and integrations which can be a messy process for industry guinea pigs at the front of the innovation adoption curve.

In our research, we see plenty of examples in which Construction enterprises have rapidly adopted technology when it made economic sense. Tech companies need to do a better job of quantifying and highlighting the return on investment to the industry adopting their technology. When this is done, adoption tends to occur much more naturally.

Successful AEC-Tech players will reinvigorate their high-growth status by positioning themselves to better attract a more diverse targeted consumer base. ConTech companies professed ~$10T total addressable market (TAM) may be out of reach today with most "Ideal Customer Profiles" (ICP) addressing only a small fraction of that.

Expansion through M&A is going to be increasingly prevalent in this market environment as built-world startups begin to feel the macro pressures of capital tightening. Capitally-sufficient ConTech giants like Procore, Autodesk, Trimble, and Bentley Systems have all been active in the M&A market over the past 12 months as price tags on value-propelling startups ripen, a trend that data suggests could continue or even accelerate in the year ahead.

Strategic solution rollups and startup mergers (platform play) are the quickest ways for AEC-tech solutions to break out of an adoption lull. Savvy M&A provides access to an immediately larger customer base, while (ideally) unsiloing stakeholders along the value chain and generating a larger pool of structured data to continue the iterative innovative process these solutions/platforms need for optimal outcomes.

The SMB Gap

The SMB construction market is incredibly underserved and if AEC-tech groups can find a way to penetrate this stubborn segment of the industry, the upside would be significant.

The cost and management alone makes Procore an unviable platform for construction company generating <$50M in revenue per year. In fact, BuiltWorlds' Benchmarking Survey focused on project management showed no GCs making under $500M per year were leveraging Procore as their preferred ERP/Project Management platform.

To break out from this growth deceleration spell, ConTech leaders need to start addressing the enormous SMB construction market which accounts for 99% of construction companies and 70% of the sector’s workforce globally. This is the most underserved segment of the market but is also the most difficult to penetrate.

These AEC groups are the late movers but as new technology becomes easier to implement and quantify the value-add, the industry will reach the illustrious digital inflection point we’ve all been waiting for (25%+ adoption). Digital acclimation will soon be table stakes for this advancing industry.

Jumping The S-Curve

The future of Construction is one where technology is invisible and seamlessly assimilated into productivity-fueled operations. A built world where integrated solutions provide comprehensive visibility to all stakeholders from the office to the jobsite, with real-time actionable insights and dynamic scheduling that mitigate project risks.

Construction companies don’t have a data problem (there is plenty of data) but rather a data management problem. There is an enormous amount of unstructured and disparate data out there that some leading organizations are now manually structuring and turning into usable metadata. An onerous and expensive process, to say the least.

Once corporate construction players are able to sustainably generate usable project data a critical mass of actionable information will soon be reached for well-positioned AEC-tech players to optimize their platforms and accompanying AI models.

Young ConTech point solutions have been running up against a growth hurdle around that $5 to $10 million ARR marker largely as a result of their lack of interoperability. Open and easy-to-use APIs will furnish the entire ConTech with automated data generation and value chain visibility.

This ecosystem remains ripe for VC picking, however, investors and innovators need to have a deep understanding of not only what the individuals in the field would benefit the most from, but what they would be willing and able to leverage with little to no additional training.

The technology should cut out duplicative & unnecessary steps/tasks while ensuring ease of use & implementation across the AEC value chain.

The recent slowdown in AEC tech is not a signal that tech adoption has ended, but rather a period of tech stack reevaluation.

Construction companies are working to ensure that value is being created from the technology they are implementing today and will continue to seek integratable solutions to fill the seemingly endless value gaps this industry faces.

It’s a maturation issue that many vertical SaaS companies face as industries advance (albeit at different paces), and is not unique to the AEC industry, which is important to keep in mind.

As mentioned in the previous article, the vast majority of larger construction players have adopted technology already and continue to deepen their tech stack (shown by expanding ACVs). However, in the face of increasingly challenging macro factors construction companies of all sizes are reducing spend where they can.

At the same time, the colossal SMB construction market that has been either unable to afford or unwilling to adopt any technology (outside of the Microsoft Suite and an iPad) is even less willing to in this uncertain macro environment, without a clear quantifiable value-add.

The market opportunity in the built world is massive, and with effective innovation development, the barriers to entry for ConTech players to integrate up & downstream (aligning with supply chain & building management technology, respectively) as well as in the SMB side of the market will continue to lower.

The less visible and more usable the technology is to the user the more willing they will be to leverage it, but this comes down to time as the AEC-tech niche remains quite nascent compared to most other vertical SaaS niches.

The good news is that the technology is already there in other verticals, it just needs to refit for the construction industry.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.