Are we on the brink of a liquidity rush in the VC markets?

Later-stage startups' valuation hemorrhaging over the past 2 years coupled with a dovish turn by the Fed could be signaling just that.

The IPO window is temporarily shut, direct listings remain an unviable option for investors seeking liquidity, and strategic acquirers are unable to satisfy this market’s financial rebalancing needs. Private market funds of all shapes and sizes including traditional VCs, Corporate venture arms, and family offices are now turning to the secondary markets as a means of portfolio restructuring.

The secondary markets provide privately held funds the option to sell illiquid assets before a conventional liquidity event (aka, IPO, a de-SPAC, M&A, etc.).

Solvency-seeking investors who have been waiting to pull chips off the table are finally seeing the light at the end of the valuation-compressing tunnel. The US Federal Reserve's rate hike cycle is coming to an end and dovish monetary outlooks last week provided later-stage valuations with some much-needed buoyancy, enough perhaps to tip their hats up towards exit options.

The Fed Puts A Bottom In VC Valuations

The Federal Reserve’s dovish outlook followed by Fed Chair Jerome Powell's market-soothing words of 2024 rate cuts last week (Dec. 14th) gave the equity markets a boost, sending the tech-fueled Nasdaq 100 to fresh all-time highs for the first time since the end of 2021.

The Nasdaq 100 index (a proxy for high-growth tech) is trading at a valuation multiple that is much more reasonable than the over-euphoric 2021 markets, which drove the Nasdaq 100’s forward P/E multiple as high as 28x. Now, more than 2 years later at an even higher price level this innovation-backed index is trading 8 turns lower at a moderate 20x forward P/E.

Data suggests that VC markets tend to lag to publicly traded high-growth price action by 6 to 12 months, indicating a potentially revived appetite for well-positioned startups in the first half of 2024.

The venture capital secondary markets are primed to be a beehive of activity in the quarters ahead as VCs rebalance their books for a later-stage exodus with liquidity demands outpacing supply by 2.7x.

With valuations poised to normalize in 2024, liquidity-seeking fund managers will be hunting for a “fair price” in the secondaries. The illustrious and subjective value of a fair price has been ostensibly unattainable over the past 12 months.

Secondary venture capital market transactions can take many forms whether it’s an LP-led transaction where one investor is seeking liquidity for an illiquid fund position, a GP-led transaction in which a fund manager is looking to restructure, or direct secondary translations from single-LP funds.

For the purposes of this article, we’re going to focus on the direct secondary markets for corporate VCs, angel investors, and family offices looking to redistribute resources.

Single-Asset Secondary Transactions

Direct (Single-Asset) secondary transactions in the VC space generally involve the acquisition of a single equity position (minority stakes in the context of VC) in an emerging business. The bidding party must perceive the stake in the startup as a viable position capable of producing a healthy return at a valuation this secondary acquirer judges as relatively low-risk.

Secondaries have a significant amount of bargaining power, with the demand for secondary market liquidity continuing to outweigh capital supply by more than 2x.

VC Secondaries have been able to attain a lofty ~27% IRR in the past 5 years, far outpacing the average IRR for a traditional VC which sits somewhere in the mid-to-high teens. Secondaries now have their pick of the golden litter (the surviving startups that have maintained healthy financials and growth), at a discounted valuation the original owners wished they could have invested at.

Secondary markets are no longer viewed as a last resort for distressed portfolio managers as a result of the expanding appetite for alternative investment vehicles with VC being a driving factor. This liquidity-generating market allows term-constrained VCs with unicorn holdings to realize returns on invested capital while the IPO window is shut and allows strategic investors to rebalance their books after a corporate restructuring.

According to Lazard's H1 2023 report, over 2/3rds of single-asset secondary transactions resulted in a 2x exit multiple on invested capital (MoIC).

Today, there are more than 1,200 active VC-backed unicorns ($1B+ private valuation) biding their time until the IPO window of favorable valuations re-opens. The number of unicorn startups has increased over 3x in the past 5 years and surged 30x in the past decade. With so many later-stage bag holders in the VC markets, funds are struggling to find syndicate leaders for their next rounds (post-Series A PropTech Funds being chief among them) which could be a primary catalyst for VCs' rush to the secondaries.

CVCs Entering The Secondaries

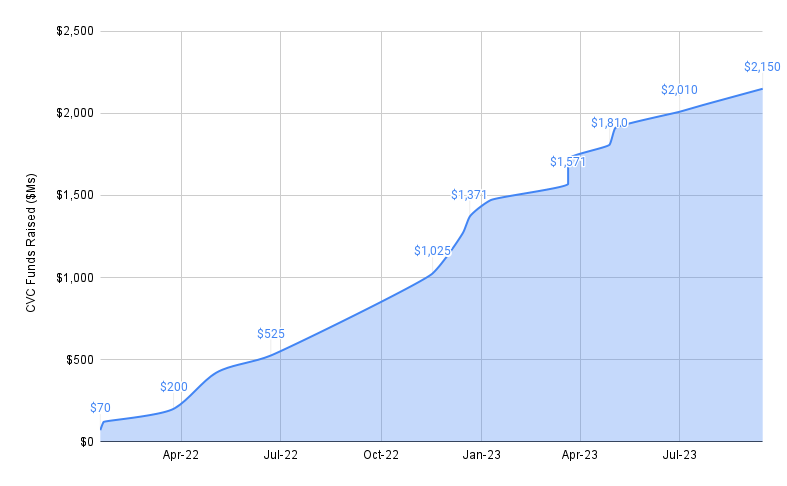

Over the past 24 months, 16 of the built environment’s corporate leaders formed venture investing arms bringing >$2B in fresh deployable capital to this young innovative niche. These corporate captains of construction are not just looking for a financial vehicle to generate returns on excess cash, but a means to be involved in this industry's digital transformation.

Corporate Venture Capital Entering The Built World Since 2022

Corporate Venture Capital arms are by nature strategic investment arms that align in some way with the corporate parent's long-term goals. Over the past few years, strategic goals in the built environment have been ever-evolving in response to the digital tidal wave that followed the global lockdowns in 2020.

Leading AEC players have been restructuring their businesses for the future since the global lockdowns. Shedding subsidiaries and divisions that don't directly contribute to strategic objectives, while bringing on market-share elevating initiatives (organically or via M&A).

Top built-world stakeholders are investing in assets that help them achieve their internal ESG mandates, and stand at the forefront of Industry 4.0 construction (data centers, smart grids, last-mile warehouses, semi-autonomous manufacturing, etc.). At the same time, AECO groups are reducing exposure to single-family residential, and new commercial offices, while driving resources into renovations and commercial retrofitting.

As VC valuations find revitalized buoyancy in H1 2024, savvy corporate venture investors will be looking to shed those holdings that no longer align with long-term strategic objectives. This will free up capital to be reinvested in startups that will drive the business's core operations.

The Fed's dovish reversal called for a bottom in high-growth valuations and those built-world CVCs that've been patiently waiting for the 'smart time' to exit holdings that have lost their strategic value are now considering the secondary markets.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.