BuiltWorlds’ Venture Forum

As the new year begins, we can’t help but reflect on a transformative year for the BuiltWorlds network. Members of the BuiltWorlds Venture & Investments Research Track and our broader network of stakeholders in the innovation and investment sphere, have played a critical role in fostering the innovation economy across the globe. In fact, the corporate venture capitalists (VCs), strategic investors, innovation teams, and corporate development teams comprising the Venture Forum (i.e., members of the Venture & Investments Research Track) are the central players in setting industry tech adoption trends.

Summarizing and quantifying the Venture Forum’s impact on industry innovation in 2024 is challenging without giving the full amount of credit that is due. Primarily, gratitude is in order for the outstanding member engagement, paired with humility for having the chance to play a role in the innovation activities helping the industry.

Instead of a “year in review” article, this is really a Venture Forum member appreciation post for their contribution in a successful year. In order to do so, this briefing will spotlight the members’ participation, key investments, accelerators, acquisitions, and other innovation projects in 2024.

AEC Angels

Consisting of five member companies—Thornton Tomasetti, Syska Hennessey Group, SHoP Architects, STO Building Group, and DPR Construction—and a cohort of advisors, AEC Angels provides key partnerships and capital to early-stage built environment startups.

The AEC Angels were key partners in the 2024 Buildings Conference, hosting our Venture Forum meeting and Demo Day. AEC Angels also hosted our AECO Innovation: A Full Lifecycle Perspective meeting as a part of New York Real Estate Tech Week in November.

AEC Angels participated in Trunk Tools’ $20M Series A Funding Round in August 2024.

EllisDon

EllisDon was a key partner and sponsor of the BuiltWorlds Toronto Summit. This was our first time heading up north and we could not have had a better inaugural experience.

EllisDon also launched its ConTech Accelerator, dedicated to shaping the future of construction, in 2024.

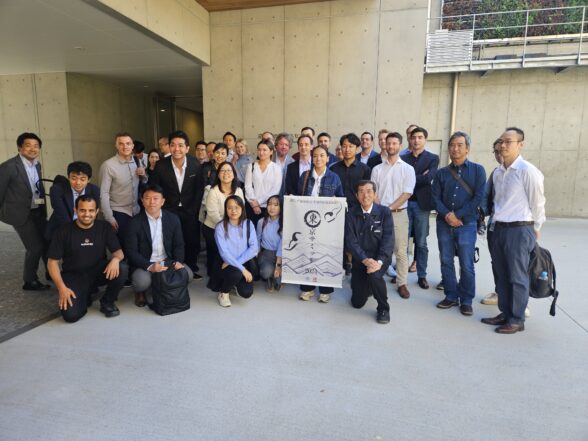

Kajima

As a pioneer in built environment tech and innovation, Kajima was a key partner and host for our Tokyo Summit in October. Kajima was also an active participant across all of BuiltWorlds Venture Forum meetings and conferences in 2024.

VINCI

Leonard, the open innovation and corporate venture arm of VINCI, partnered with BuiltWorlds for the Paris Summit, hosting a day of programming at its offices.

Leonard’s accelerator programs—SEED, Catalyst, Intrapraneuers, and AI—are transformative for startups across the globe operating in construction, mobility, energy, and real estate.

Leonard by VINCI is an active venture investor, having participated in Bosso’s Pre-Seed round.

GS Futures

GS Futures, the CVC arm of Korean conglomerate GS Group, traveled across the globe with BuiltWorlds this year and participated in numerous thought leadership panels.

GS Futures was also an active direct investor, participating in a few notable funding rounds:

Stanley Ventures

Stanley Ventures, the corporate VC and innovation vehicle of global equipment and tool manufacturer, Stanley Black & Decker, was a key participant in our Venture West, Venture East, and Offsite Construction Conferences. The team lent their perspectives on numerous conference panels and participated on multiple Demo Day pitch competition judges’ panels.

Rival Holdings

Rival invests in organizations within the built environment to catalyze innovations, actively transforming the industry. In November, Rival announced the launch of Defy Investments, an investment and management company focused on acquiring and growing commercial and residential construction companies.

Notably, Laux Construction, a prominent general contractor acquired by Rival Holdings in June 2024, will now join the Defy portfolio.

Rival has also been an active venture investor, playing a key role in Automated Architecture’s (AUAR) $3.3M Seed round.

CRH Ventures

The $250 million corporate venture and innovation fund of CRH that invests ambitiously and strategically in ConTech and ClimateTech startups across its focus areas: circularity, decarbonization, productivity, and water infrastructure.

CRH Ventures has empowered built environment entrepreneurs this year through its building materials, future of roads, and future of water accelerator programs.

CRH Ventures also made key investments in FIDO AI, Sublime Systems, and Cool Planet Technologies.

Andersen Ventures

Andersen Corporation supports built environment entrepreneurs through its venture and innovation vehicle, providing financial investments, strategic partnerships, and joint ventures (JVs).

The Andersen Ventures team was an active participant in the BuiltWorlds network, leading a breakout discussion on residential construction tech at the Venture East Conference.

Andersen has been a strategic partner evaluating JV opportunities with multiple startups, including NxLite–participant in the 2024 Toronto Summit Demo Day pitch competition.

WND Ventures

The VC arm of DPR Construction, WND Ventures is changing the way the AEC industry builds through strategic investments in productivity, quality, safety, supply chain and sustainability.

WND Ventures, an active participant across BuiltWorlds slate of events, hosted the Venture Forum meeting at Venture West in San Francisco.

WND Ventures has been an active investor throughout the year, playing a key role in Trunk Tools’ $20M Series A.

Owens Corning

Owens Corning is a leading global manufacturer and distributor of building products, such as roofing, insulation, doors, shingles, fiberglass composites and more. Owens Corning kicked 2024 off with the $3.9 billion acquisition of Masonite to strengthen its interior and exterior door business line. This was one of the largest acquisitions executed by a Venture Forum member this year.

Owens Corning has also been an active direct investor in startups (BotBuilt’s$12.4 million Seed round at the end of 2023) and deeply engaged with BuiltWorlds events across the globe.

NOVA by Saint-Gobain

The corporate venture and innovation arm of Saint-Gobain, the oldest building materials manufacturer in the world, was an active investor in 2024. A few notable investments:

- FibreCoat $21M Series B

- JUUNOO $6.6M venture round

- Merlin Solar $31M Series B

- Treble $12M Series A

- Fortera $85M Series C

Nova also participated in Cemx’s Construction Startup Competition, alongside other Venture Forum members this year.

The 2024 Paris Summit commenced with a reception hosted by Saint-Gobain at its headquarters, offering a panoramic view of the city.

ARCO Ventures

The ARCO/Murray and ARCO Ventures team have been integral in our commitment to engaging the community at home in Chicago. In addition to being active sponsors of industry innovation, the ARCO team has been involved in our newly launched Midwest Forum and Chicago event series.

ARCO also reaffirmed its industry-shaping thesis by participating as an operating partner in Suffolk Technologies’ BOOST accelerator program.

Titan Cement

Hailing from Greece, Titan Cement has been making waves with its recently established CVC through limited partnership (LP) positions and direct investments in sustainable materials startups. Titan participated in C2CA’s $11 million Series A. Titan has also been actively involved in BuiltWorlds’ European endeavors.

UFP Ventures

The VC arm of UFP Industries, a global manufacturer of wood products serving the packaging, construction, and consumer markets, has been highly active over the last year through its direct investments. UFP Ventures recently invested in Calmfloor by FSD Active in advance of its planned 2025 Series A.

The UFP Ventures team has also been front-facing in the BuiltWorlds network, speaking on a panel at Venture East and judging numerous Demo Day pitch competitions.

Nemetschek Group

The Nemetschek Group, a globally leading software provider for digital transformation in the AEC/O and media industries, has been an active direct investor in built environment startups, participating in Document Crunch’s $21.5 million Series B and SmartPM’s $5.5 million Series A. Nemetschek also acquired GoCanvas, a leading workforce management solution provider.

Nemetschek has been actively engaged with BuiltWorlds throughout 2024 across Venture East, Venture West, Paris Summit, and Toronto Summit.

Cornerstone Building Brands

Cornerstone Building Brands has actively expanded its product offering suite and geographical reach of its residential building materials through the acquisitions of Mueller Supply Company and Harvey Building Products.

The Cornerstone team is dedicated to fostering industry innovation through opportunistic startup direct investments and has been actively involved in Venture Forum activities throughout the year, such as judging Demo Day pitch competitions at Venture West.

Suffolk Technologies

Suffolk Technologies is the VC platform affiliated with Suffolk Construction. Suffolk Tech takes a unique approach to corporate venturing with its multiple LPs alongside its anchor LP, Suffolk Construction. Suffolk Tech works closely with the Suffolk Construction, facilitating pilots and use cases for its portfolio companies.

Suffolk was the key sponsor of the Venture East Conference, facilitating the exciting tie-in with Suffolk BOOST Demo Day. Suffolk BOOST is an industry-leading accelerator for early-stage startups.

The Suffolk team has also been actively involved in the BuiltWorlds network, speaking on numerous panels across multiple events. Suffolk CEO and Chairman John Fish also kicked off the Venture East Conference with some opening remarks.

BuildTech Ventures

BuildTech Ventures is supporting the innovation economy of Latin America as the only built environment specialist investor in the region. BuildTech Ventures was a key participant in Ainwater’s pre-seed raise.

Trimble Ventures

Trimble is a leading solution provider in the built environment, offering a full suite of services for design, engineering, and project management. Whether it’s making direct investments, the Construction Startup Competition or executing its SketchUp 0-60 Challenge, Trimble has been active in supporting startups in the built environment. Trimble made waves with its acquisition of FlashTract and also invested in Outbuild’s $11M Series A.

Trimble has participated in numerous conferences and Venture Forum sessions throughout the year. The team has played a critical role in facilitating Venture Forum meetings at the Paris Summit, Venture West, and Construction Tech. The Trimble team has also lent thought leadership on a panel at the Paris Summit.

Bouygues Ventures

As a key partner for the Paris Summit, Bouygues hosted both the Venture Forum and Building Tech Forum meetings as well as the event’s Demo Day pitch competition at its headquarters. Bouygues Construction Ventures has been a catalyst for built environment technology making direct investments and participating in industry accelerators, such as Suffolk Technologies’ BOOST.

At the Paris Summit Venture Forum Meeting, we got the chance to do a fireside chat with Aidan Halter, head of group strategy and venture, to learn more about the European tech adoption and venture trends.

Ferrovial

Ferrovial underscored its commitment to innovation through participation in our inaugural Infrastructure Conference and the Construction Startup Challenge. Ferrovial is also engaged in a JV with fellow Venture Forum member VINCI Construction to build a subway line in Toronto.

Ferrovial has spoken on panels at the Paris Summit and the Infrastructure Conference in 2024. Ferrovial has also been a critical partner in expanding BuiltWorlds’ presence in Spain through our Madrid Meetup.

Nesma & Partners

Nesma is the leading general contractor in the Kingdom of Saudi Arabia. Nesma is actively pursuing startup investment and strategic M&A opportunities. Nesma completed its acquisition of Kent Construction, expanding the geographic scale of its operations.

Caterpillar Ventures

CAT Ventures is a long-standing CVC advancing the heavy equipment and construction industries. CAT Ventures made a key investment in Magnus Metals’ $74 million Series B. CAT Ventures participated in the Construction Startup Challenge and also has been actively involved in BuiltWorlds’ Venture Forum meetings since joining the group in 2024. The CAT team has been active participants at Construction Tech, Venture East, and the Chicago event series.

2024 Venture Research Recap

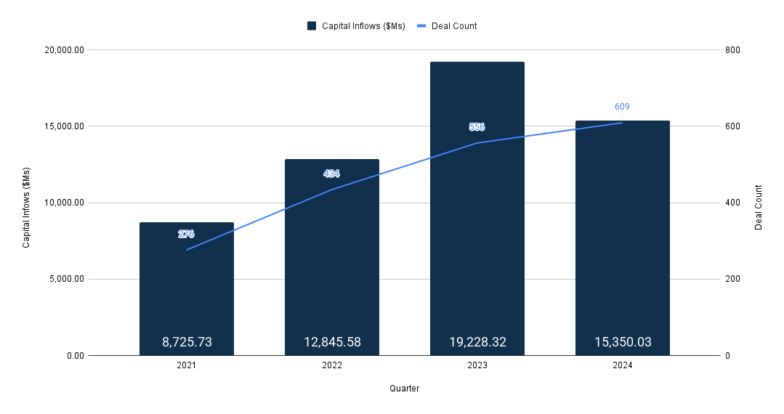

It is evident that the BuiltWorlds Venture Forum plays a critical role in shaping the industry’s tech adoption standards. This group has catalyzed two major shifts in the venture capital markets in 2024.

After severely lagging in the middle two quarters of 2024, the year closed with $5.7B of venture capital inflows across 202 deals in Q4 2024–the second-most active quarter on record in terms of inflows and the most active quarter in terms of deal count. This was underpinned by an investment shift towards more capital-intensive materials, equipment, and robotics (i.e., HardTech solutions).

Historically, the built environment VC landscape has been dominated by software startups. These startups typically require less capital than asset-heavy materials and hardware businesses—which require “patient capital” to support research, development, manufacturing, and longer sales cycles. CVCs and strategic investors make the perfect partner for these startups and their hunt for patient capital because they often have higher amounts of investible capital and less time restrictions than institutional VC funds.

GC members in the Venture Forum have been at the forefront of another substantial transformation in the landscape of built environment VC. Startups disrupting the infrastructure space (i.e., advanced equipment and software solutions for the horizontal construction, utilities, and energy sectors) have attracted the lion’s share of venture dollars in the last two years. GCs in the Venture Forum—Kajima, VINCI, Ferrovial, Suffolk, Bouygues, and DPR, to name a few—have invested heavily in infrastructure technology to support their burgeoning horizontal construction practices. This has led to a surfeit of capital for startups operating in the sector.

Looking Ahead

2024 was an active year for built environment tech acquisitions, with over 100 deals reported. Startup exits via acquisition are expected to continue their growth trajectory in 2025 due to tech maturation and macroeconomic tailwinds. Corporate and private equity (PE) activity is expected to increase in 2025 because of lower cost of capital (i.e., from lower interest rates), strong GDP growth, and increased corporate profits. Investors have also shown interest in continued support for HardTech startups—specifcially, those with embedded software components.

Secondly, infrastructure technology venture interest has proven its staying power. With only $480 billion spent out of the $1.2 trillion Infrastructure Investment and Jobs Act funding package, continued spend on infrastructure projects is anticipated. Therefore, more capital will be available to spend on infrastructure tech startups. Investors are suggesting that they are still in the early stages of deploying capital in this space as infrastructure repair and construction still has a long way to go.

It was evident through the Venture Forum’s investment activity in 2024 that strategic and corporate investors in the built environment set the tone for tech adoption.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.