BuiltWorlds' recently released the 2024 Annual Project Management & Oversight Benchmarking Report, an in-depth analysis of trends in project software implementation. Overall, the majority of respondents believed that their company's efforts in project management & oversight were 'very good' (41%) or 'excellent' (33%). These sentiments reflect an increased understanding of the benefits of project software solutions and subsequent increased adoption, as reports of "excellent" project management success have more than doubled since 2023.

Below are some significant insights and takeaways from the annual report.

Document Management Implementation

Contractors look to document management software solutions to ease the burden of manual processing. These tools act as valuable assistants, saving time digging through thousands of files, emails, and messages to track information down. There is a growing integration of artificial intelligence technology into document management systems. AI technology is expediting the document management process by not only parsing through information at unparalleled speeds but also extracting useful insights from that data. Solutions on the market can read and convert written text, assess and assign risk ratings, and be spoken to like you're asking a co-worker, not a computer a question. As solution providers continue to integrate AI into their products we will enhance not only document processing abilities but meaning extraction, creating efficiency and value throughout the construction process.

It is noteworthy that nearly 90% of respondents indicate that their project management platform additionally functions as their document management solution. Of the nearly 90% of companies, 1/3 of them have identified a separate primary document management solution. Given the amount of information required in managing a project, having a consistent database increases cross-team collaboration and documentation. If all the data is in two separate systems, the likelihood of the information gathered being communicated efficiently and effectively with all stakeholders is slim. Utilizing the same solution as a primary document management and project management tool, as 57% of survey respondents do, streamlines information sharing. The research shows that project management solutions that incorporate document management features are being sought after and implemented by contractors.

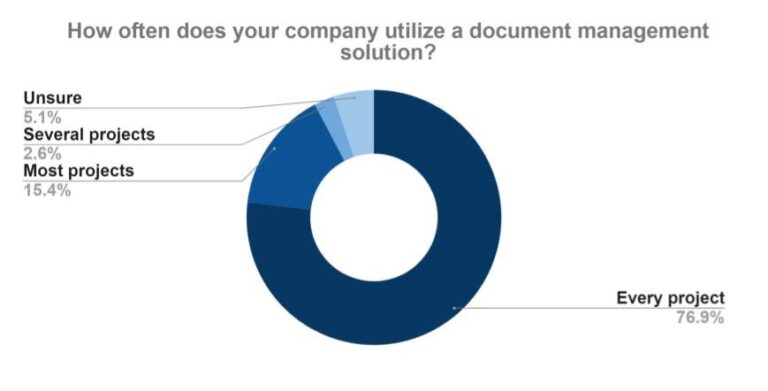

The utilization of document management solutions was the highest compared to all of the tech specialty areas in the report. The vast majority of survey respondents (92%) indicated that they currently use a document management solution on every or most projects. Non-adoption is non-existent, with no respondents indicating that they do not implement this technology.

Customer Relationship Management (CRM)

Customer relationship management adoption is a response to initiatives in the industry to enhance communication and coordination. There is an effort to streamline the flow of data to optimize the use of CRMs and integrate that data into pre-construction and other project management tools. Ensuring proper selection, adoption, and use of CRM tools is critical because they are the first place in the project lifecycle any data on a project will be populated, and it is critical for project teams to be able to access that data.

Unlike the other tech specialty areas surveyed, there were only four unique solutions identified by respondents as being utilized by their company. Notable in data gathered for CRMs, unlike most other areas surveyed, is that many of the adopted solutions are industry-agnostic instead of purpose-built for the AEC. Because of the lack of AEC specific solutions, an area of emerging technology in the industry is CRM solutions purpose-built for the AEC space.

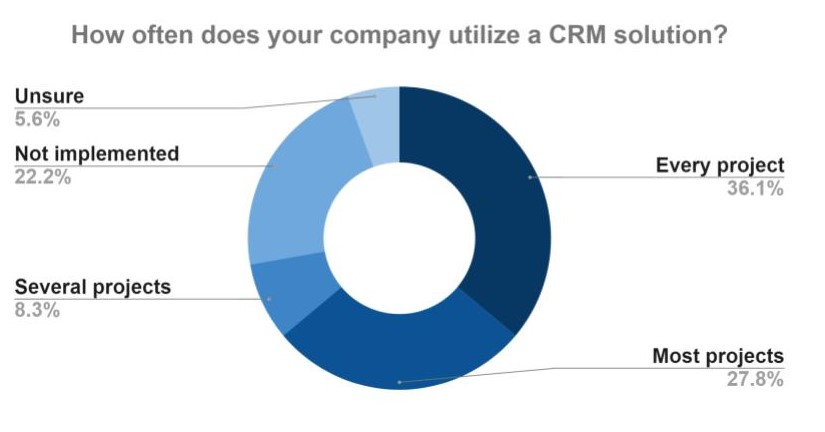

The majority, 64%, of survey respondents indicated that they currently use a CRM solution on most or every project. An additional 8% use a CRM solution on several projects. Twenty-two percent have not implemented this technology and the remaining 5.6% are unsure about their organization's CRM adoption. With a non-implementation rate of 22%, customer relationship management solutions showed the lowest adoption rate among areas surveyed. This percentage of non-adoption is twice as high as the next highest category, human resource information systems, with 11% not implementing. Typically, non-implementation is around 6% or lower for tech specialties surveyed, making the lack of CRM adoption notable.

Project Management Investment

Of all the project management and oversight tech specialty areas, project management solutions receive the most capital investment in terms of both quantity and quality. Notably, project management startups have raised over $550M of capital investment between Q1 of 2020 and now, per the BuiltWorlds Venture Dashboard. That $550M was spread over 54 deals in the same time frame. With 70% of respondents using a project management solution on every project, there is a large and growing customer base for these solutions.

The research showed that solutions from large software companies currently dominate the project management landscape. The large general contractors that make up the majority of the 2024 Project Software Benchmarking Survey respondents are inclined to adopt these more expensive and comprehensive solutions. However, the proliferation of startups creating dedicated project management software solutions for general contractors highlights a desire for compact systems that smaller contractors can adopt.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.