After over 5 centuries of globalization, the world’s largest economies are disconnecting to insulate themselves from geopolitical vulnerabilities. The pandemic catalyzed 10 years of digital pull-forward in a matter of 10 months, providing economic superpowers (the European Union, the United States & China) with the technological wherewithal necessary to become totally self-sustainable (such as scalable sustainable energy sources, ubiquitous digital connectivity, automated manufacturing, productivity-driving AI, etc).

The conflict-driven energy crisis in Eastern Europe and strained political relations between the two largest economies on the planet (US & China) furnished international superpowers with a reason to repatriate previously outsourced operations.

In just a 24-hour span last week, the world’s leading central banks illuminated just how disjointed these economies have become over the past 3 years. The US Federal Reserve announced it would be holding interest rates steady Wednesday afternoon (6/14), while the European Central Bank (ECB) pushed their benchmark rate 25-bps higher (to the highest level in 22 years) to fend off the boundless inflationary pressures that continue to plague the region (largely as a result of the energy supply shock from the war in Ukraine).

At the same time, the People’s Bank of China dropped its benchmark rate by 10-bps as the world’s second-largest economy grapples with the international repatriation of production, self-inflicted regulatory measures on its largest tech companies, and overlending to the heart & soul of the Chinese economy, small businesses (SMB/SME), who are now struggling to repay these debts (SMEs represent 60% GDP, 79% of job creation, & 68% of exports in China).

Globalization has long been seen as the cornerstone of economic success with each region leveraging its respective core competencies for the greater good of all. Today, rapidly advancing technology, and mounting geopolitical concerns have pushed prudent economies to function autonomously (not requiring the support of international trading partners).

What This Means For AEC Innovation

The construction & real estate sectors have remained regionally fragmented throughout the past 500 years of globalization, providing this sector with an edge amid this digitally-impelled deglobalizing economic shift.

Burgeoning innovation in the increasingly tech-thirsty AEC space coupled with the build-out of Industry 4.0 position the built world to account for a growing portion of global output.

The built world (real estate & construction) currently accounts for more than 16.9% of global GDP and that percentage is poised to grow throughout the "Roaring 20s" -- the compounded annual growth rate (CAGR) of global GDP is ~3%, while the built world is expected to grow at a CAGR between 5% & 11% through 2030.

Our economy is entering a phase of economic acceleration. Industry 4.0 is underlined by technologies such as:

- Ubiquitous digital connectivity

- Artificial Intelligence (AI)

- Autonomous Manufacturing/Robotics

- Last-Mile Warehouses

- EV Infrastructure

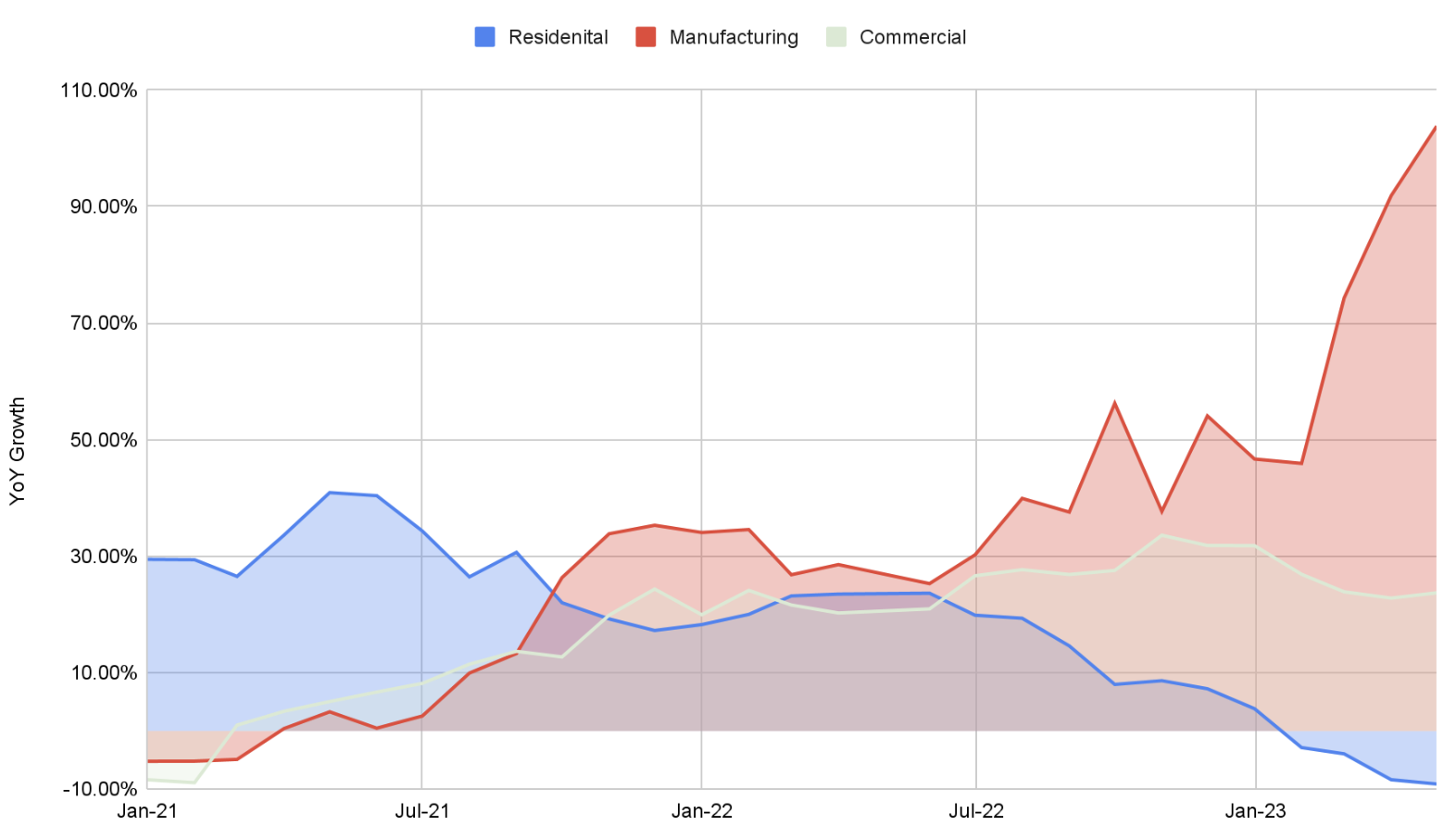

The buildout of this next iteration of civilization is illustrated in the US's increasingly secular construction market, which continues to hit new all-time highs each month.

As you can see from the chart below, the downtrend in residential construction (historically the driver of cyclicality for the AECO space) is being more than offset by the boom in new manufacturing investments (autonomous plants, semiconductor fabricators, 3D-printing facilities) as well as non-office commercial (datacenters, last mile warehouses, etc.), which now account for over 30% of non-residential construction (compared to 20% pre-pandemic).

3 Global Built World Venture Deals

€1.2M | Seed | 6/16/2023

Country: Belgium

Investors: Led by Peak

Enersee uses AI to give energy and portfolio managers transparency and deep insights into their energy and utility consumptions, on a sensor level up to full patrimony view. This allows its customers to generate substantial energy cost savings and reduce their carbon footprint.

€34M | Series B | 6/14/2023

Investors: Led by OMV AG (Strategic Partner), with follow-on investments from Eavor’s existing partners including bp Ventures, Eversource Energy, and Vickers Venture Partners

Eavor™ is an Alberta-based tech company that has invented a new geothermal power generation technology that overcomes all the traditional roadblocks of geothermal. We call this new highly effective green power generation system Eavor-Loop™. Our system is made with existing commercial componentry configured in a completely novel way. We use the most recent advances in drilling techniques and merge them with the latest heat-to-power generation technology to create the world’s first scalable, steady, and reliable source of green power.

€2.5M | Venture | 6/13/2023

Investors: Strategic fund from Husqvarna Ventures

Removal of small trash on grass and gravel is a painfully manual process, as conventional cleaning machines cannot be used there. Angsa develops an autonomous robot, which detects even small trash items using artificial intelligence. The detected objects are then removed in a targeted manner, preserving the grass and insects.

The autonomous robot enables festival organizers or parc administrations to save money and keep their areas clean while increasing the cleaning speed and quality.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.