Silicon Valley Bank (SVB), the go-to financial institution for startups, VCs, and industry innovators (16th largest US bank), closed its doors on Friday as the overzealous VC funding environment of 2021 and early-2022 begins to backfire on overleveraged tech-focused financiers.

50% of US venture-backed tech & healthcare startups, and 88% of Forbes’ 2022 Next Billion-Dollar Companies list banked with SVB, not to mention the slew of financial institutions (VC funds & banking partners alike) who held money in SVB accounts.

But if you or your company banks with SVB (or Signature Bank, which subsequently fell Sunday afternoon) don’t worry, regulators have stepped in to snuff out any systemic concerns about the US financial sector, ensuring the public that all depositors will have access to their funds this week.

So what drove this unexpected run on Silicon Valley Bank, and what does it mean for the built world's nascent innovative ecosystem?

What Happened?

The unprecedented Federal Reserve-driven yield curve inversion – the US 2-Yr yield driving a full percent above the US 10-Yr rate for the first time in over 4 decades – has put incredible stress on US banks, who traditionally borrow short-term at a lower rate and lend long-term at a higher yield to attain returns, in a very vulnerable position.

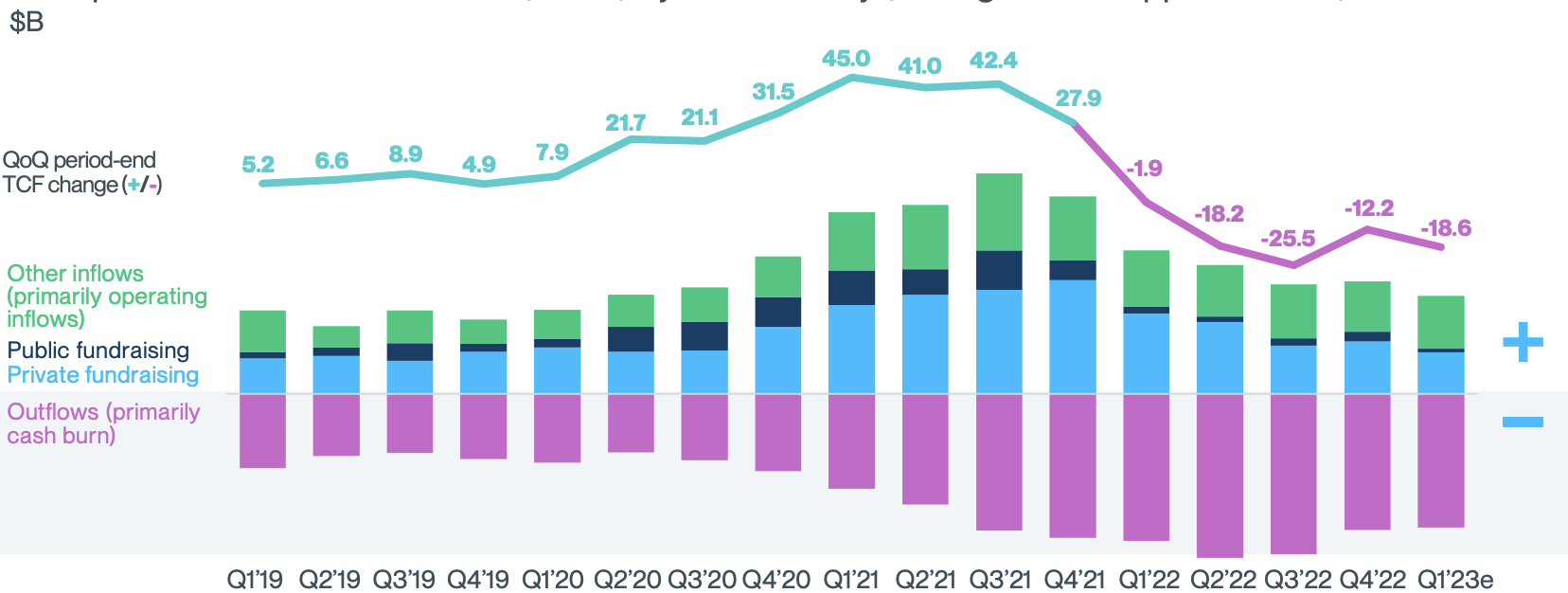

This Fed-fueled yield curve inversion coupled with a swelling number of distressed startups running up against the end of their roughly 18 to 24-month capital runways (cash running out) and few VCs coming to the rescue, drove founders to pull deposits faster than SVB was prepared to cover as deposits slowed drastically in the face of soaring interest rates. You can see the deepened outflows in SVB’s deposit throughout 2022 below:

Wednesday evening (3/8), SVB released an emergency investor update informing its shareholders that it would be raising funds engaging in an ~$21B securities liquidation (US Treasuries & stocks), $1.25B emergency common stock offering (15% discount), and $15B debt extension deal in order to maintain its required (risk-adjusted) loan to debt ratio.

This capital crisis announcement incited VC funds to advise all their portfolio companies to pull deposits inevitably catalyzing the bank run that brought this 40-year-old innovations-empowering financial institution to its knees – SVB was ultimately unable to raise the necessary funds to meet liquidity demands.

Friday morning (3/10), The Federal Deposit Insurance Corporation (FDIC) took control of SVB’s assets, calling this new holding entity the Deposit Insurance National Bank of Santa Clara.

The collapse of SVB marks the most significant US banking fallout (holding over $300B in assets) since the financial crisis of 2008 and is already sending shivers down the spine of the US financial sector, with the S&P 500 financials tumbling over 12% in the past 5 trading days.

Sunday, the inescapable ripple effect of SVB's failure began, pulling Signature Bank down, which catalyzed regulators into action.

The systemic implications of the financial dominoes that were poised to fall alongside these two financial behemoths led to a joint announcement from the US Treasury Department, the Federal Reserve, and FDIC, that these institutions would be fully insured under the "systemic risk exception", meaning all depositors would be made whole – comforting those worried that the FDIC’s original $250,000 cap on SVB's previously uninsured deposits would remain in place.

Unfortunately, equity holders and unsecured debt holders of Silicon Valley Bank will not be provided with the same protections.

The Risk

However, this systemic risk exception that regulators have employed fully insuring these two entities' depositors is not comforting to other regional/small banks that are not fully insured by the FDIC, who may just face a bank run of their own into these newly formed depository shells.

The Deposit Insurance National Bank of Santa Clara (the bank formerly known as SVB) and Signature Bridge Bank (formerly Signature Bank) are now some of the safest depositories for high-wealth individuals and small businesses to place their cash.

Could the temporary preservation of these two SMB banking giants mean the death of many more (with more than 85% of US bank deposits being uninsured)?

The entity formerly known as SVB is currently in the process of being bid away, whether that means it will be reinstated as a subsidiary of a larger institution or its assets sold in parts is yet to be known.

The collapse of SVB and Signature Bank (2nd & 3rd largest financial fallouts in US history) will likely act as a firehose in the already cascading startup flush-out with VCs sitting on their hands, while many founders are forced to look toward a distressed buyout with cash for payrolls beginning to run dry.

Implications on Built World Startups

Luckily, the AEC-Tech ecosystem’s nascency and elevated reliance on strategic investment partners (corporate venture capital groups or CVCs), provide this startup niche with a buffer against the illiquidity of this primarily growth-stage focused lender (meaning much less lending to businesses with <$5M in ARR, aka early-stage).

Founders in AEC-tech have typically taken on a much more conservative capital approach than the growth-at-all-costs model that many other startup niches have employed. This is because of the nature of built-world innovators, many of which come from the construction/building industry and understand the sloth-adjacent speed at which tech adoption occurs, making growth-at-all-costs an impractical approach.

Venture fundraising in the built environment has also been bucking the broader VC market stagnation (Q4 being the worst quarter for VC fundraising in roughly a decade), with over $3B in new dry powder since mid-November poised to continue advancing this final frontier of digital adoption -- nearly 3x the fundraising we tracked over the same period last year (see BuiltWorlds Institutional Dashboard for more).

Strategically motivated VC funds seem to be popping up once a month (if not more frequently) as legacy industry players realize the necessity of hedging against the rapidly approaching digitalized future of Industry 4.0.

Join Us At Venture West To See First Hand How Built World Innovators Are Reacting To SVB's Collapse

Click Here For More On Venture West

Discussion

The irony is that this collapse of the most venture-friendly bank in the US could easily have been avoided if its managers and directors had raised more capital in Q3 or Q4 of 2022, diluting their ownership, but avoiding both the total loss of their equity and avoiding the hair raising weekend of panic and concern about how to meet payroll this week that multiple construction tech companies with all of their funds in the bank faced.

You must be a member of the BuiltWorlds community to join the discussion.