Every quarter, the Commercial Construction Index Survey offers an insight into the state of affairs amongst contractors in the US building industry. Created by Dodge Data & Analytics in partnership with the USG Corporation and the US Chamber of Commerce, the detailed report offers a health grade of the industry every four months. The fourth quarter report, released last week, highlights that despite labor shortages in the industry, it seems to be healthy and stable.

Looking forward over the next 6 months, most contractors plan to be hiring or maintaining their workforce size. These statistics don’t rise to the levels predicted in the first two quarters of the year, though, suggesting those surveyed were overzealous with their predictions at that time. Regardless, this report indicates an industry maintaining healthy employment levels.

Issues arise, however, when it comes to bringing new labor and technology onto jobsites. 56 percent of contractors have difficulty finding skilled workers and an overwhelming 92 percent of them reported being concerned about the workforce’s skill level. Hindered by a reluctant workforce and time constraints, 90 percent of contractors surveyed stated that they do not consider current jobsites to be very efficient.

To begin to achieve further efficiency, prefabricated building components, improved labor productivity, and smarter, more streamlined project management are all on contractor’s radars in the near future. 55 percent of contractors, compared to 47 last quarter, plan on further investment in tools and equipment as well.

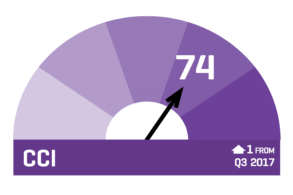

Despite concerns about access to materials and skilled labor, not only are many contractors forecasting to increase hiring, but nearly all respondents of the survey had relatively high confidence in the market’s ability to provide new opportunity next year. While positive statistics like these rise each quarter, dire issues in the industry seem likely to inhibit some projections from becoming a reality. Nevertheless, the index rates this quarter’s health “74,” or a “healthy market,” up one point since the last report.

There’s reason to be optimistic about the US building industry moving forward; it would seem contractors, albeit hesitantly, are as well. The Commercial Construction Index’s statistics, however, still highlight dilemmas that need to be addressed such as the labor shortage and lack of innovation on the jobsite.

In February, BuiltWorlds will continue to lead the charge toward enhancing jobsite technology and efficiency at its Projects Conference in New York City. Then, in November, dialogues on workforce issues will be advanced further at the Future Workforce Conference.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.