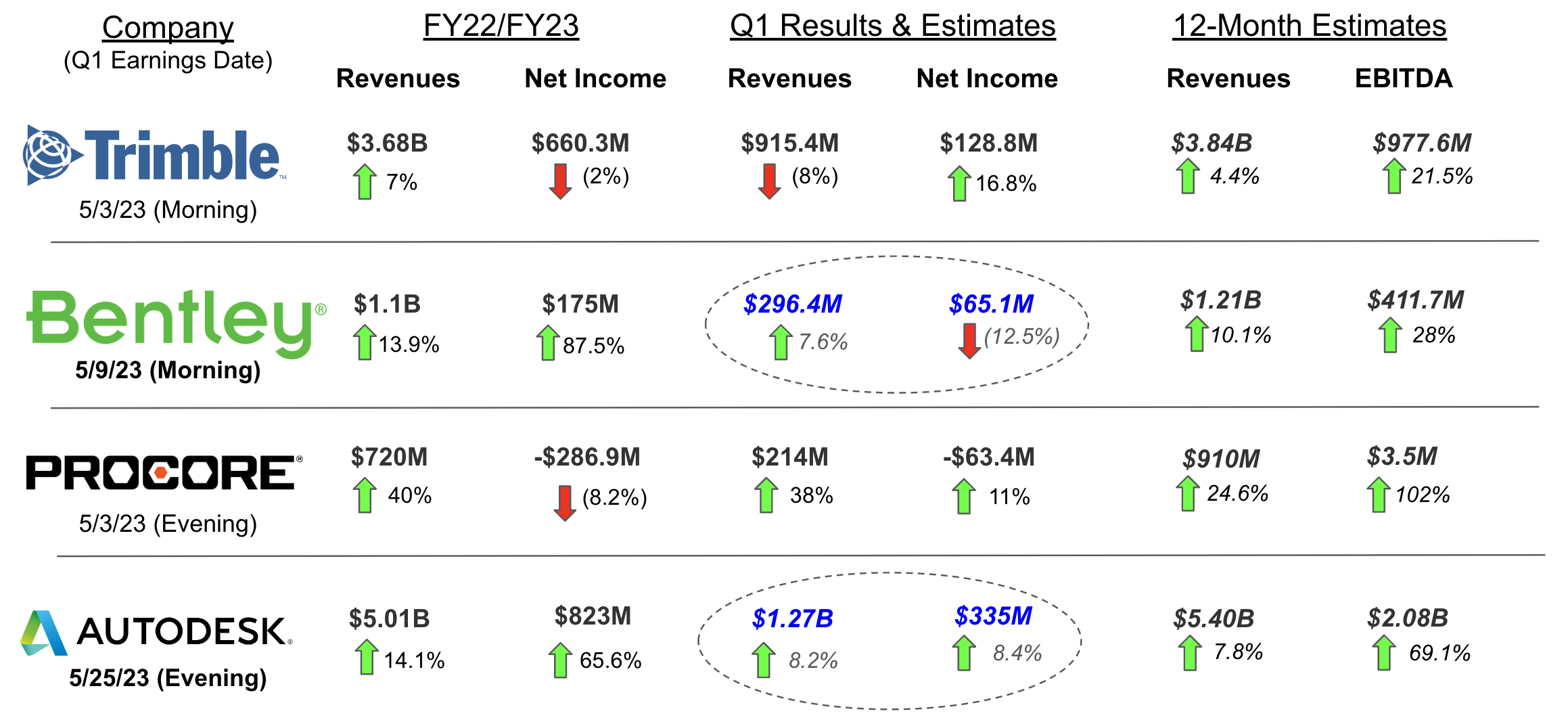

The publicly traded innovators of the built environment have begun releasing Q1 earnings and initial results seemed to reinforce the notion of secular industry adoption despite mounting macroeconomic uncertainties.

Trimble (TRMB) and Procore (PCOR) were first up to bat in this pivotal Spring earnings season when they reported last Wednesday (5/3), illustrating economically agnostic growth in AEC-tech.

This notion bodes well for well-positioned built-world startups that are just now finding their market traction as legacy construction & building companies (across the adoption curve) seek out the most operationally accretive solutions to avoid obsolescence in this rapidly digitalizing world.

Procore (PCOR)

Procore, a leading Project Management SaaS Platform provider for contractors, beat both top & bottom-line estimates in its quarterly report Wednesday evening (5/3) while the seemingly conservative management team (having beaten Wall Street estimates in the past 6 consecutive quarterly reports) raised full-year revenue guidance from 24% - 25% year-over-year growth (quoted in the Q4 earnings call) to 26% - 27%.

Procore's Founder & CEO, Craig Courtemanche, acknowledged the macro-uncertainty the construction sector faces in its earnings call (e.i. a potential recession, labor shortages, difficulty attaining credit, etc.) but reiterated the secular tailwinds that continue to drive investments into this space – a tidal wave of new government spending, record levels of construction employment, an operational necessity to embrace new technology, and an incredibly buoyant backlog of demand.

The operational benefits of digitalization continue to fuel Procore's growing customer base, which broke above 15,000 businesses in Q1 (adding over 600 new net customers last quarter), but will Procore be able to continue its robust growth trajectory if economic conditions sour, and competition deepens with new innovations pouring out of the built world startup ecosystem daily.

What was really novel for Procore investors in this quarterly earnings call was the official announcement of its new in-house insurance vertical: Procore Risk Advisors.

This deepening FinTech offering is expected to materially increase Procore's long-term addressable market as it would ostensibly align stakeholders by lessening the financial burden that disjointed legacy insurance brokerages put on all value chain participants. Procore has the operational breadth, customer data, and deep-rooted industry relationships to optimize this sector's complex insurance landscape for the benefit of all.

That being said, Procore's Risk Advisory vertical will remain a near-term operational liability until it's proven the ability to deliver.

Procore is still in its early innings of FinTech implementation and the persistent hurdles surrounding its integration with Levelset (going on 2 years since this $500M acquisition) gives me some concern about Procore's ability to effectively execute this new Insurance Brokerage offering.

This new vertical isn't expected to materialize any real returns for a couple of years, but with unmatched customer data and best-in-class partnerships with Allianz and Swiss Re, this could be an enormous long-term opportunity. It is already grabbing the attention of some major insurance groups like Travelers which has already agreed to subsidize 20% of Procore's Platform for its construction customers in order to remain competitive.

Procore is becoming increasingly proactive in its strategy to dominate the budding AEC-tech platform ecosystem as it battles for market share against long-standing competitors (like Autodesk, Bentley, & Trimble) and emerging startups looking to grab a piece of this growing pie.

PCOR jumped over 5% in its post-earnings price action last week and looks like it could have further to run as investors and analysts alike get increasingly bullish on this construction tech giant's more aggressive market share-capturing approach.

The total addressable market for built-world technology is beginning to accelerate with the rest of our digitalizing economy.

Trimble (TRMB)

Trimble, while managing to outpace EPS estimates, fell short of analysts’ revenue expectations reporting negative year-over-year growth. However, I would take this missed quarterly metric with a grain of salt as management did not provide forward guidance in its previous earnings call, and is undergoing the (typically) painful transitions to subscription-driven ARR-dominate income that's become the gold standard of startup business models.

Despite a product-related topline decline (downtick in one-time hardware & software sales), Trimble organically grew its ARR by 13% YoY (Buildings & Infrastructure ARR growing by an outsized 20%) to $1.65B, making this high-margin recurring revenue source the primary driver of future sales expansion. Analysts anticipate topline acceleration and margin improvement in the quarters ahead for Trimble as its ARR offerings continue to propel this company forward.

Trailblazers tech giants like Microsoft and Adobe underwent the same near-term financial contracting transition from on-premise software to cloud-based subscriptions a decade ago, which resulted in the incredibly visible long-term growth outlay that has boosted these stocks to the justifiably rich valuations they sit at today.

With cloud technology already ubiquitously utilized across sectors, Trimble's transition shouldn't be nearly as financially burdensome as the aforementioned early cloud adopters. As long as Trimble continues to proactively position itself at the leading edge of infrastructure & building technology, the company should be able to drive the same sticky recurring revenues of a growing customer base on expanding ACVs (average contract values) that companies before it (like Microsoft & Adobe) were able to achieve.

The State of The Publicly Traded Built World

Analysts have been increasingly bullish on the upside opportunities of built-world technology as this industry closes in on its long-awaited inflection point (25%+ sector adoption) - shown by the secular demand for Procore & Trimble's SaaS solutions in their latest financial reports.

This impending critical mass of AEC-tech adoption will spotlight the construction industry's legacy winners, while the unadopted players head towards obsolescence.

Bentley System's (BSY) Infrastructure Tech-oriented Q1 report this morning (5/9) should further highlight areas of digital strength. Keep an eye out for Autodesk's (ADSK) earnings later this month to see how effective this group has been in gaining traction following its recently launched of its Construction Cloud Platform, which was built to connect its bread & butter Design & Engineering stakeholders with the rest of the building value-chain.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.