Learning About The Future of Construction Logistics Plans with HERE Technologies

Report Overview, Introduction

As engineering and construction companies look to keep up with or even lead the industry in adoption of technology, BuiltWorlds' Benchmarking and Survey Program provides the members a yardstick to see where they are actually adopting technology relative to the overall industry and to understand what solutions their peers are using most frequently in each functional area examined. Beyond the feedback that individual members are able to gather about their journeys relative to their peers, survey data provides and interesting picture for the whole BuiltWorlds Membership about that actual pace of technology adoption in the industry, and the technology companies leading the pack.

Demographics of the Pre-Construction Survey

The pre-construction survey looks at adoption in six process areas: Scheduling, Estimating, Modeling and Simulation, Bidding, Scheduling, Value Engineering, and life cycle costing. Thirty-four companies completed the survey.

Members of the BuiltWorlds network, the companies taking the survey tend to be larger, general contractors with more employees. Even within the membership, General Contractors participated at a significantly higher rate, compared to specialty contractors and engineering firms:

- 23 General Contractors (68% of Respondents)

- 9 Specialty Contractors (26% of Respondents)

- 2 Engineering Firms (6% of Respondents)

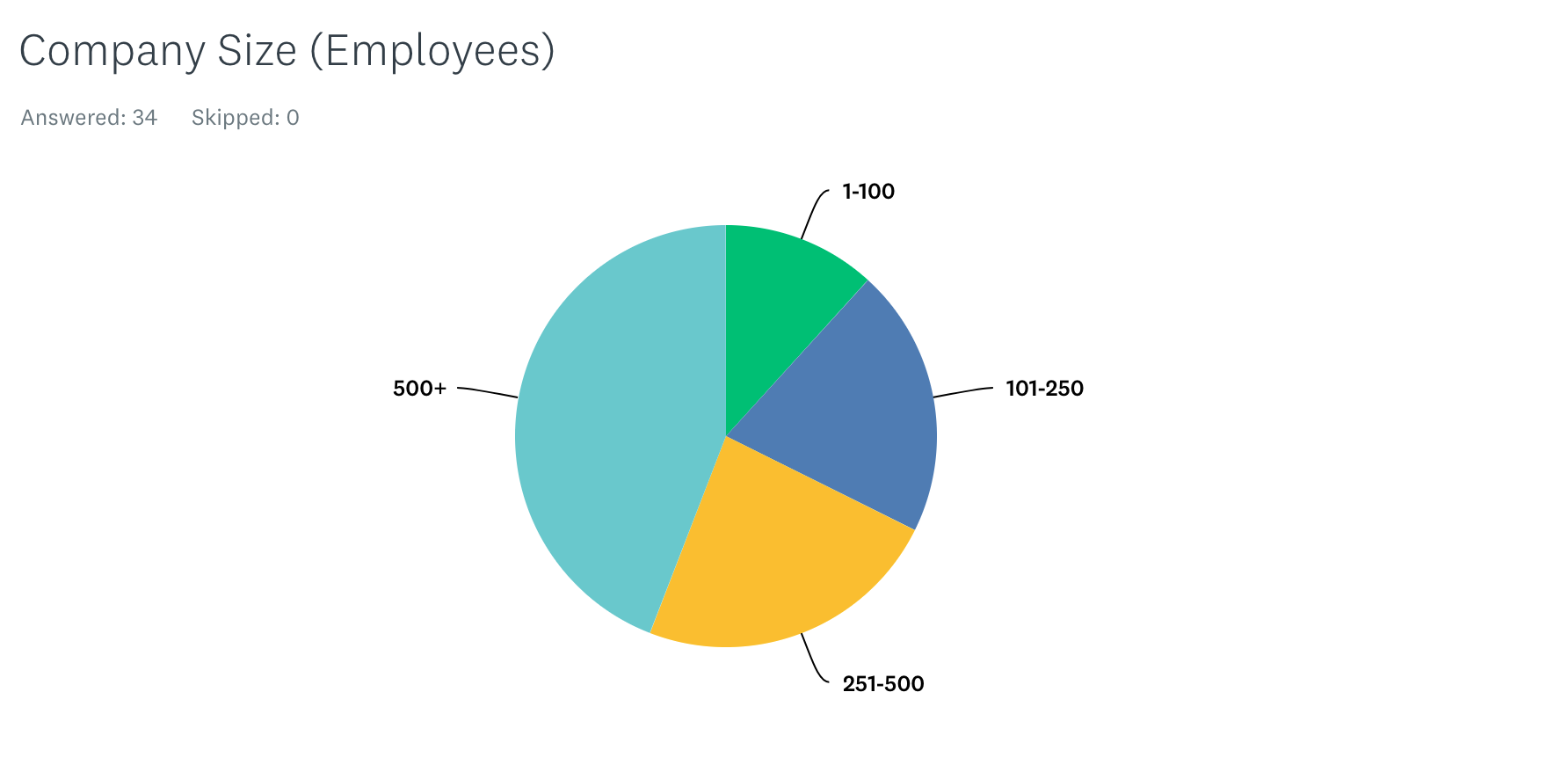

They also skew heavily to the bigger companies in the market:

- 67% have more than 250 employees

- 4% have fewer than 100 employees.

The Big Takeaway: As Survey Participation Grows, and More Smaller Companies Join, Adoption Rates Are Actually Dropping

As we have added companies to the survey over the past year, one might expect to see increased adoption in later respondents. All the attention focused on software adoption might lead one to think we would see adoption rates increase among survey completed at the end of 2020 versus those completed in the beginning. In fact, the opposite was the case. However, adoption rates actually fell several points with the addition of responses in the second half of the year, compared to the first half.

Smaller Firms Appear to Be Lagging Larger Firms

Only 42 percent of respondents reporting in after the first half of the year reported having 250 or more employees, versus respondents in the first of the year. In the first half of the year, fully 82% of respondents reported having more than 250 employees.

The Industry Could Be Facing a Digital Divide

Our survey garnered responses from about a quarter of our E&C Membership relatively quickly. However, responses have come more slowly from the remaining 75%, and as those responses have come in, they actually appear to have brought adoption rates down. Additionally, respondents were disproportionately larger general contractors. This suggests that, past a relatively small sliver of the industry, broad based adoption of emerging technology solutions is still in its infancy. Further, a question begins to arise as to whether some firms will ever be in a position to catch up.

Compared to the Initial Sample in Q1, the Investment Picture Has Become More Mixed

Adding evidence to the existence of a divide between the first group of "early adaptors" who participated in the survey in the beginning and the rest of the industry are mixed statistics around investment and hiring.

On One Hand, Covid Appears to have Chilled Technology-Related Hiring

In the fourth Quarter of 2019 and January of 2020, we surveyed our membership ahead of our Buildings Conference. In that survey, 78% of the 26 respondents planned to add VDC personnel in the coming year. By the time we got into mid 2020, that number among survey respondents had dropped to just one in four planning to add to their teams.

VDC Hiring Plans Pre and Post Covid

On the Other Hand, Post Covid Non-Staff Tech Spending is Rising

To learn more, we added a questions about spending on tech. When asked whether they have increased or decreased their budgets for innovation and technology in the past year 75% percent of respondents said spending had increased. This question was only added to the survey in December. So, responses are fewer than for other questions. However, this also says that while companies may have pulled back on adding staff, their actual spending on software and technology has risen, post-Covid.

With More Firms Reporting Bigger Budgets for Tech, Why Did Adoption Appear to Decline?

We don't know. We'll have to look at this more closely as more firms take the survey and as firm take the survey again in 2021. There are a number of possible explanations:

- Firms that have increased spending are fast adapters playing catch up with the early adopters who already have increased spending and added solutions.

- Firms increased spending on technology in areas outside of pre-construction solutions. Anecdotally, our Engineering & Contractors Adoptors Forum Members have focused more of their conversations around Accounting, Video Conferencing, Cloud Solutions, and other back-end solutions that aren't necessarily industry-specific or specific to the automation of project processes.

- More Smaller firms are joining, and they are just starting from much further down the adoption curve than the large, early adopter.

While firms do appear to be spending more on technology solutions that in the past, this additional spending may just not necessarily be manifesting itself in estimating, smart jobsite, or other emerging technology areas as much as in more bread and butter needs, such as video conferencing solutions and accounting systems. Based on the backlog of topic requests from our E&C Adopters Forum, it would appear that many contractors are focuses on technology adoption in more basic and generalized need areas.

BIM Adoption, Another Indication of the Limits of Digital Disruption

Approximately 12.5% of respondents indicated using BIM on 80% or more of their projects, while about an equal percentage indicated zero usage or not using BIM on more than 10% of projects. The rest of the responses clustered between 25% and 50%. This statistic is important, not only because it suggests that even the most progressive industry players are still making limited use of Modeling Software, it also means that all of the downstream solutions that depend on the existence of detailed models cannot achieve enterprise-wide adoption and will remain constrained to beta testing, large projects, and special niche situations for some time.

Where Adoption is Strongest:

Bid Management, Scheduling, and Estimating Software Have the Highest Rates of Adoption.

On Most or Every Project, Firms Have Adopted the Following Solutions (Rates For All Firms Participation in the Benchmarking Program in 2020):

HOWEVER...Adoption Drops Precipitously Among Smaller Firms:

Pre-Qualification Software

- Compass (Bespoke Metrics) - Emerging Player leveraging AI.

- Textura Pre-Qaulification Manager (ORACLE)

- TradeTapp (Autodesk) - Top Solution

- Vertikal

Bid Management Solutions

- B2W Software

- BASIS

- BidVue (Stratusvue)

- BuildingConnected (Autodesk) - #1 Most Used Solution.

- CMiC

- Dodge Data & Analytics

- Pantera Global Technology

- Planhub - Emerging Player.

- Procore - Top Solution

- SmartBid (ConstructConnect) - Top Solution.

Estimating

Sage Timberline, OnCenter, and WinEst were the only solutions used by multiple respondents.

- Planswift (ConstructConnect) - Take-Off Software.

- Assemble (Autodesk) - Integrates with Sage to Integrate models with estimating. - Top Solution

- Heavybid (HCSS)

- Ineight

- Joyne - Emerging Player

- OnCenter (ConstructConnect) - Take-Off Software - Top Solution

- Procore

- Stack

- Timberline (Sage) - Top Solution

- WinEst (Trimble) - #1 Most Used Solution

- ViewPoint (Trimble)

- Pype (Autodesk) - Although they were purchased by Autodesk this year, we still mark them an emerging player for their second generation solutions.

Scheduling

While Primavera was the top solution, Microsoft Project was a close second, and many respondents indicated using both.

- ALICE - Emerging Player

- Asta Powerproject

- B2W

- Civalgo - Emerging Player in Infrastructure

- Corecon

- Microsoft Project - Top Solution

- Primavera (Oracle) - #1 Most Used Solution

- Synchro (Bentley)

- RIB iTWO 4.0

With the broad adoption of baseline take-off, invitation to bid, and scheduling software already in place, contractors have entered an experimental phase with "next generation" estimating, bidding, and scheduling applications. Companies like Bespoke, Pype, and ALICE would be examples of this trend We explore some of those areas in our associated Analyst Briefing.

Digital Modeling and Simulation is an Important Emerging Opportunity (Adoption on Most or All Projects):

Beyond the "Big Three" pre-construction activities, larger players are beginning to enter a maturation phase in their initial adoption of modeling and simulation tools. However, in one interesting twist, smaller companies registered a slightly higher rate of broad-based adoption of Modeling and Simulation Tools than larger players.

Further, while enterprise wide adoption may not be there for the majority of companies, more than three fourths of our Members surveyed are working with modeling and visualization software. From the emergence of Revit, Navisworks, and Vela (Autodesk suite products) and the concepts of clash detection gained traction more than a decade ago, engineering and construction companies in the building sector have been experimenting with modeling on several projects in their shops.

Recent Discussions Around Modeling and Visualization

In June, we held two Analyst Calls focused on pre-construction planning tools with a primary emphasis on planning for Building Projects. First, we met with Shane Scranton of IrisVR and Jamie Roche of Helix for a discussion of Preconstruction Planning: Models & Visualization. That call really centered on how digital twins and virtual reality tools can be leveraged to help improve the planning of our projects. In the next call in the series, we met with Benjamin Welle of Perkins + Will and Andrew Zukowski of Join to examine how better access to data and cloud computing is allowing companies to bring more sophistication to value analysis.

...However, Enterprise-Wide Usage is Still Very Limited, Compared to More Traditional "2D" Estimating, Scheduling and Bid Management Solutions.

While more than 75% of companies surveyed are working with BIM and Simulation software, fewer than 25% of companies have adopted those solutions on most or all of their projects. This data suggests that companies are still working to find the value of BIM or are only finding that value on certain projects.

Modeling and Simulation

Microsoft continues to dominate this category, with Navisworks, Assemble, and Revit garnering most of the responses.

- Autodesk (Revit, Navisworks, AutoCAD, Recap) - #1 Most Used Solution

- Archilogic

- BIMx (Graphisoft/Nemetschek Group)

- FARO Scene

- Fuzor

- Helix - Emerging Solution

- IRISVR - Emerging Solution

- Revizto (Vizerra)

- Tekla (Trimble)

- Synchro Software

Further Indications of The Digital Divide: While the Larger Firms Focused on Opportunities in Value Engineering, Smaller Firm and Others Who Joined the Survey Later Remain Focused on Bread and Butter Scheduling and Bid Management Software.

...Across the Board, Adoption of Value Engineering and Life Cycle Costing Solutions Continues to be Extremely Low.

Adoption Rates for Companies with 250+ Employees:

Adoption Is Actually Higher for Life Cost Analysis Software

Zero firms with 250 or fewer employers indicating usage of value engineering on most or every projects, and only one firm indicated use of life cycle costing software on most or all projects.

Concept Estimating, Value Engineering, Life Cycle Costing, Design Assistance.

- Autodesk (AEC Collection)

- B2W Software

- Destini (Beck Tech) - Rated a top solution in the Estimating Category.

- Join - Emerging Technology Solution.

- Modelogix (Trimble)

- Bldbox - Emerging Technology Solution

- BuildingSP - Emerging Technology Solution

- Bionova One Click LCA - Emerging Technology Solution

- Microsoft Excel

- Sage

While there are a few established players in the Value Engineering and Life Cycle Costing Space, no solution rated high enough to be a top solution in the sector. This is a major problem area for the industry, based on their rankings, but it also appears to be an area characterized by a lack of entrenched incumbents and an increasing number of emerging solutions. Additionally, the major players in the sector are not well represented in this area. All of these factors lead to our conclusion that we will see more rapid development of this part of the sector in the years to come.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.