Over the past decade, residential and commercial construction sector solutions have soaked up most of the investment dollars flooding into the sector and most of the solutions developed have been aimed at these sectors within the industry. However, stimulus packages, recession fears, a hunt for "blue ocean," and a more urgent prioritization around developing solutions to address climate change are all driving an increasing amount of attention around solutions aimed at how we build, maintain, and operate infrastructure. According to the US Census Bureau, as of July of 2022, more than $359 billion was spent on infrastructure projects in the United States on an annualized basis, roughly 22% of total construction. It is a massive sector that encompasses street and road, water, sewer and waste, power, communications, and other structures. In our annual in depth look at the state of Infrastructure Tech, we look at later stage solutions gaining broader adoption in the industry, earlier stage solutions that offer promising newer and more disruptive opportunities for the industry, and also some of the investment activity in the sector.

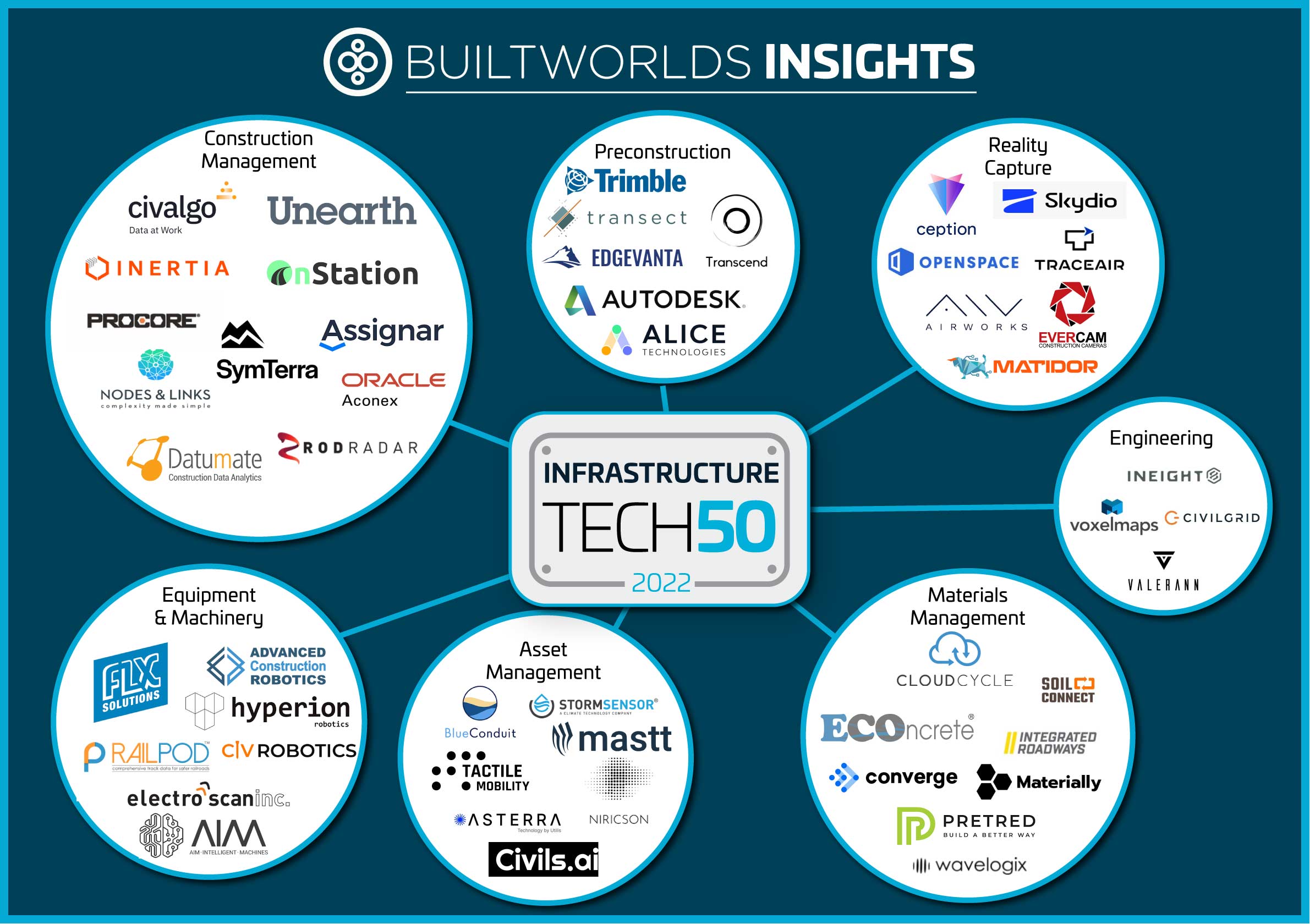

2022 Infrastructure 50: New Solutions, Marketplaces, Sustainability

2022's Infrastructure Tech List and Report represent our seven years since we first began tracking the sector, and there are many trends now clearly emerging. This year's list reflects several including:

- The Continuing Importance of Equipment

- Maturations of Project Management Applications

- Further Development of Reality Capture, Drones.

- A Growing Emphasis on Sustainability

Below is a further exploration of these trends.

2022 Infrastructure 50 List

Click here to view this year's list.

Equipment Management Solutions (Still) Particularly Dominate This Sector

While residential and commercial building sectors certainly benefit from the use of equipment. Anyone who has seen tower cranes dotting growing cities know that. However, with site work typically a much bigger part of projects, underground work, and often heavier components, heavy civil and infrastructure projects tend to require much more heavy equipment than building projects. These needs draw the attention of heavyweight construction equipment manufacturers like Caterpillar, Komatsu, and Doosan, and also major heavy civil and infrastructure contractors who, unlike their building construction counterparts, often own their equipment.

As with Building Construction, Project Management Solutions have Also Reached Relative Maturity, Characterized by Specialized Features and growth in Infrastructure Solutions in Platform Marketplaces

A series of transactions in recent years may offer the best evidence of the development of infrastructure tech's project management sector:

- Bolstering its leading position in heavy civil and infrastructure construction, Trimble recently acquired B2W, a company that bills itself as a leading provider of estimating and operations solutions for the heavy civil construction industry.

- Leading Private Equity firm, Thoma Brava purchased HCSS, a leader in estimating and project management solutions for the heavy civil and infrastructure market last year.

- In 2020 Bentley Systems went public in an IPO valuing the business, long known as a leader in infrastructure planning, design, and project management at more than $6 billion.

It is also noteworthy that larger platform technology companies like Trimble, Bentley, Autodesk, ORACLE, and PROCORE pushed deeper into this sector through strategic acquisitions and integrations. In an effort to keep our list fresh and with very limited space to cite solutions that illustrate major themes in established and emerging players, as well as in an effort to keep the list fresh from year to year, we were not able to list all relevant companies in a list of 50. In our public-facing company directory, one can find hundreds of solutions across the categories covered on this List.

Reality Capture, Particularly Drone Applications Find Market Fit in Infrastructure

There has been so much active in the area we broadly refer to as "reality capture" in recent years that we decided to add a category to the List this year covering that area. Because infrastructure projects tend to cover large tracts areas of land outdoors, infrastructure has been a particularly good area for the development of drone technology, and we feature a number of those companies on this year's list. However, other technology companies using fixed cameras, cameras on hard hats, and hand held devices are also becoming increasingly common on infrastructure jobs, as the industry works to deploy technology to automate the monitoring of job sites and the collection of data regarding the progress, quality, safety and other factors surrounding infrastructure projects.

Increasing Focus on Carbon Reduction in Infrastructure Yields More Solutions

Earlier this year, we released a report on the rise in interest in sustainability in the materials incorporated in the projects the industry builds. While logistics and supply chain management continues to be of growing interest, the industry is increasingly looking at ways to reduce the carbon footprint of materials like concrete that is a primary ingredient in the work and also technologies that reduce the carbon footprint of the process of building infrastructure projects. Fleet electrification is just one way companies are working to reduce co emissions in the process of building, itself.

For a More In Depth Examination of the Trends Impacting Infrastructure Tech in 2022, Read our Infrastructure Technology Report and Join our Infrastructure Tech Analyst Call Series

Access the BuiltWorlds 2022 Infrastructure Research Report

Each year, we publish reports covering the major trends and companies in the key topic areas we cover.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.