Nutrition is similar to Q1 2024’s built world VC market in the sense that macronutrients can portray one narrative while the micronutrients another.

A chocolate protein bar may look like a nice healthy snack until the nutrition facts are inspected to find 15 grams of sugar and a slew of processed ingredients. The chicken breast, however, may have a similar macronutrient profile (protein, carbs and fats), but differentiates itself as the healthier choice when you consider the micronutrients like vitamins and amino acids.

Similar to weighing snack options, segmenting built world VC market activity is critical to truly understand the trends. The BuiltWorlds Venture & Investment team segments deal data in three main categories: Infrastructure Tech, Building Tech and Construction Tech.

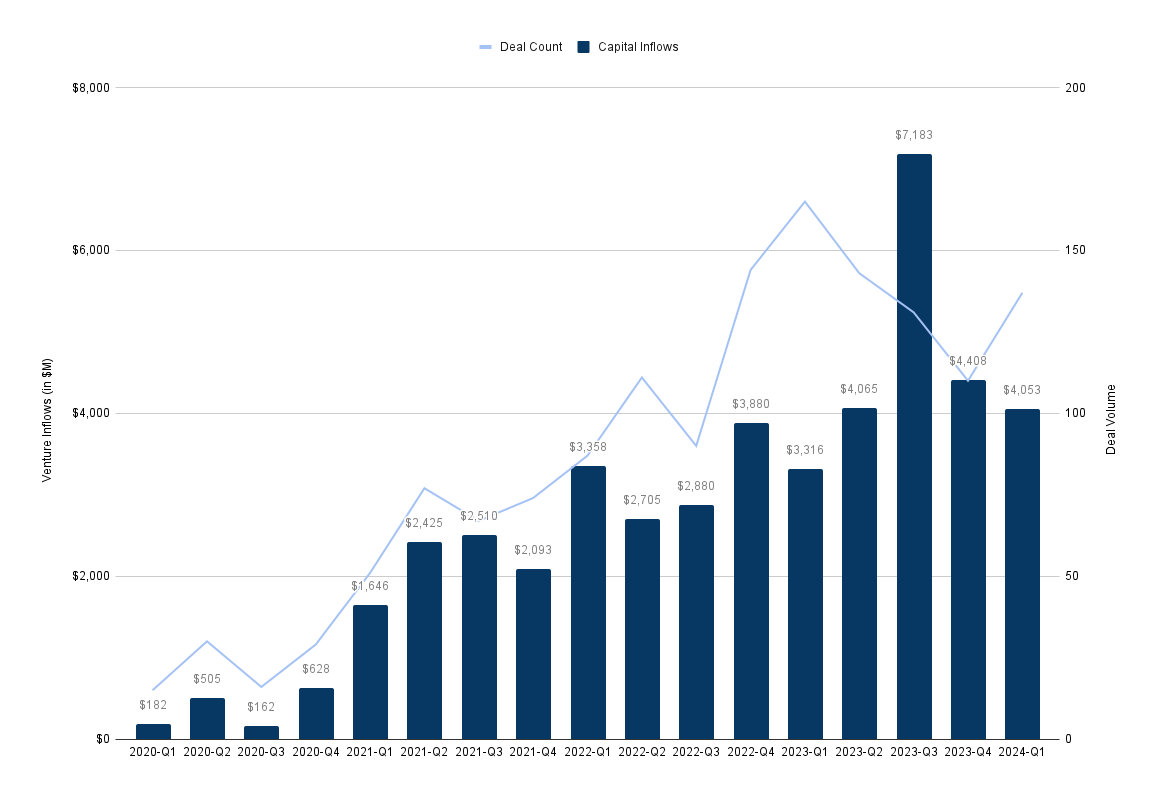

The Q1 2024 Venture Report revealed the big picture that total built world venture capital market data (aggregated for the three tech categories) departed slightly from the prior quarter. On the surface, capital inflows declined by $355M (8.8%) while deal volume added 29 more deals (a 26.6% increase) quarter over quarter, however further segmentation of the data reveals positive undertones for the industry.

Over the last three quarters, Infrastructure Tech startup funding has largely been a crutch for the AEC VC market while Building Tech and Construction Tech have been hamstrung. This quarter experienced the first uptick in Construction Tech and Building Tech inflows and a subsequent decrease in Infrastructure Tech over the same time period.

However, this decrease in Infrastructure Tech VC inflows is mostly due to skewed data in the prior quarters.

The macronutrient and micronutrient contradiction become apparent once the numbers are parsed out and the funding rounds are more closely inspected. Despite less capital inflows at the aggregate level, Q1 2024 was a marker for built world investing as there were no megarounds ($1B+ deals) skewing the data and deal counts trended upwards.

Q3 2023 experienced four deals with an average valuation of $1.15B. Q4 2023 had two deals valued at $1.02B and $1.2B. Considering that Q1 2024 deal volume increased substantially and VC inflows were largely in line with the previous quarter’s without the inflation of $1B+ funding rounds, the quarter was an accurate picture of a strong built world VC environment.

The fundraising environment remains open for investors with a built world-centric thesis. Four substantial fund raises occurred in the first quarter: Innovation Endeavors raised a $630M fund, World Fund closed a $324M fund, Prudence raised an $80M Fund III and Zacua Ventures closed an oversubscribed inaugural fund of $56M.

Exit opportunities remain sparce with few built world startup exits. Private equity is still the preferred exit lever for built world startups as few are IPO-ready. The mergers and acquisitions market is starting to open up despite high interest rates suppressing valuations for sellers. Sellers are still holding out for the big exit valuations but the buy-side is willing to pay a premium for quality built world startups that are exit ready.

Global private equity firms are sitting on record levels of dry powder (uncommitted capital for investment) and are ready to inject liquidity into the markets when interest rate pressures alleviate. This liquidity will stimulate the venture markets and increase startup valuations.

Log in and read the full Q1 2024 Venture Report for headwinds/tailwinds of each tech category, further trend analysis of each tech category, investment data segmented by startup stage, trends in built world AI investing, institutional M&A market activity and a 2024 outlook.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.