Risk appetites are expanding as investors look to the end of this valuation-crushing rate hike cycle (which began 18 months ago now), with the S&P 500 & tech-fueled Nasdaq 100 driving back into bull market territory (20%+ off recent lows). These primary public market indices closed Monday at their highest level in over a year.

At the same time, the broader venture capital market is beginning to loosen its grip on capital reserves, but with a portfolio-tilted focus. VCs are rushing to close bridge-funding rounds for some of their most promising yet cash-stretched portfolio companies as the first half of 2023 begins to wrap up.

This sentiment is driven by the notion that private market investors have opened up their pocketbooks just enough for founders to grab a small cash injection to shore up their balance sheets in preparation for that next big funding round, which many are scheduling for the end of 2023/beginning of 2024.

Startups are wary of trying to raise any consequential round at this precarious juncture as the US Federal Reserve grapples with the trifurcation of economic signals surrounding their monetary policy (aka interest rates) - inflation holding above the Fed's 2% target for over 2 years now, unemployment remains at a historic low (both of which are reasons to continue raising rate), while a potentially disastrous credit crunch looms from the cascade of depositors rushing out of Main Street banks (by the $10s of billions) in the wake of recent SMB/regional bank fallouts (reason to cut rates).

Federal Reserve Expectations (June 13-14th Meeting)

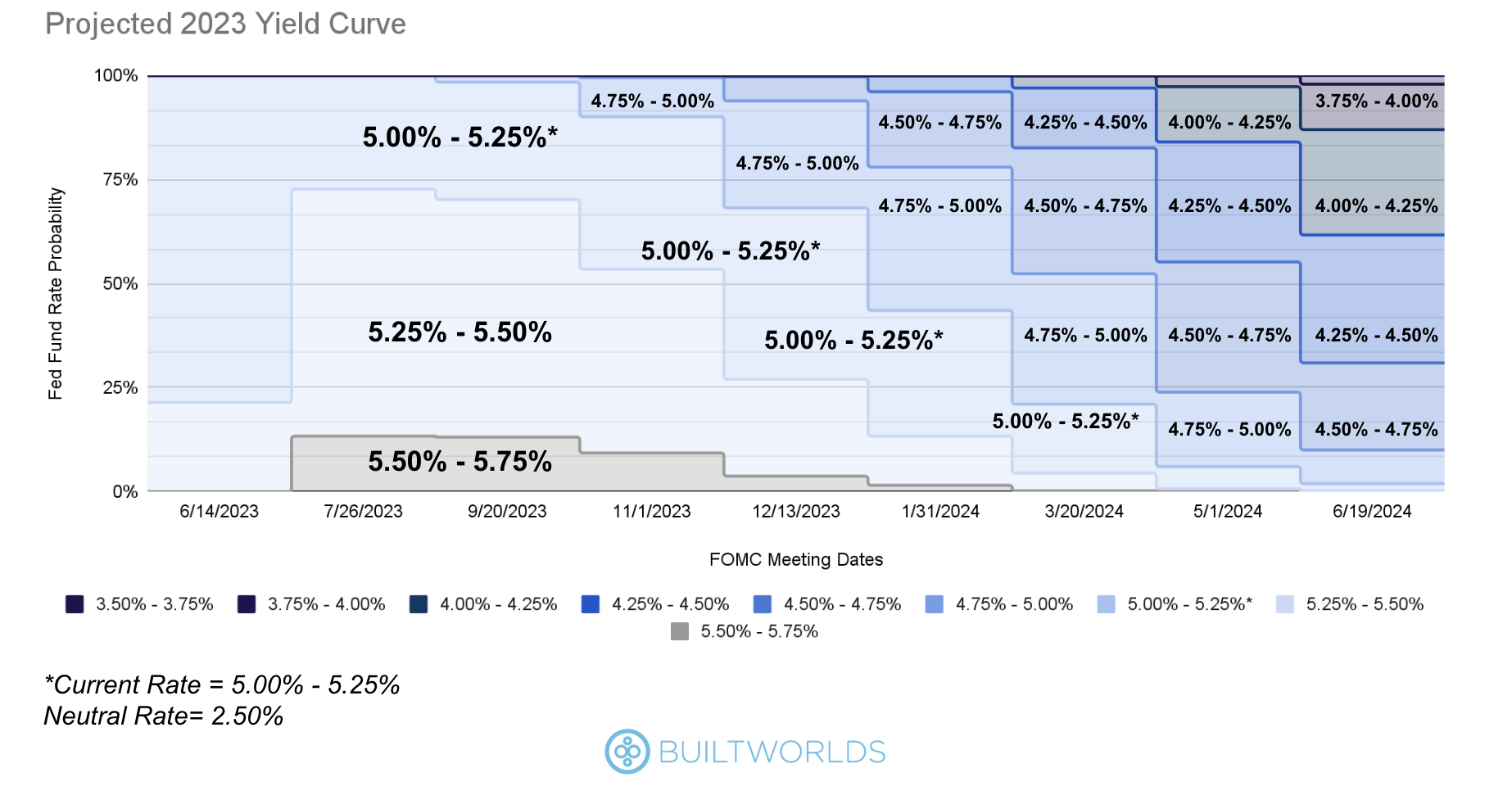

The US Federal Reserve is expected to pause its rate hike cycle tomorrow afternoon with a fresh set of forward-looking projections, which will shape the increasingly precarious market yield curve.

This morning's May CPI report (a measure of inflation) was in line with economists' expectations, decelerating to a Year-over-Year (YoY) increase of just 4%, depicting the slowest pace of inflation since March of 2021.

The markets have tentatively priced in one more (25-bps) rate hike before the end of the summer as inflationary pressures although decelerating continue to hold buoyantly above the Fed's 2% target. On the other hand, the recent mass exodus from SMB & regional banks has put elevated pressure on America's Main Street businesses that rely on the collapsing lines of credit to maintain healthy operations.

We will see how the Fed reacts to this nebulous situation in tomorrow's FOMC release (which will include forward-looking projections) at 2 pm ET and Fed Chair Jerome Powell's subsequent Press Conference at 2:30 pm ET.

3 Highlighted Deals

$50M | Series C | 6/12/2023

Investors: Led by Koch Disruptive Technologies, alongside new investors Zimmer Partners and one of the largest U.S. energy companies. The round includes participation from existing investors U.S. Venture Partners, Delek US Holdings, Atento Capital, Spider Capital, and Arkin Holdings

Percepto is the leading autonomous inspection and monitoring solution provider, revolutionizing how industrial sites monitor and inspect their critical infrastructure and assets.

Listed in TIME magazine’s 100 Best Inventions of 2021, Percepto’s AIM (Autonomous Inspection and Monitoring) platform fully automates visual data workflows end-to-end, from capture to insight. AIM leverages the Percepto Air drone-in-a-box portfolio alongside other robots and visual sensors.

With Percepto AIM, industrial companies improve productivity, safety, and sustainability.

Percepto’s solutions are trusted by Fortune 500 customers on six continents including Koch Industries, Delek US, and Siemens Energy. The company is the recipient of multiple prestigious awards including the AUVSI Xcellence Award, Edison Gold Award, and Frost & Sullivan Global Enabling Technology Leadership Award.

$42M | Series B | 6/6/2023

Investors: Bessemer Venture Partners led with participation from Initialized Capital, Brick & Mortar Ventures, Rainfall Ventures and others

Since January 2020, Curri has been modernizing the logistics industry by providing a seamless and efficient platform for businesses to manage their industrial supply chain. By offering end-to-end logistics services and a nationwide elastic fleet, Curri helped its customers move over $1 billion worth of supplies across the United States last year. Enabling companies like Ferguson, Winsupply, Sherwin-Williams, Graybar, Johnstone Supply, and United Rentals to quickly and securely deliver complex loads ranging from heavy machinery to lighter loads such as pipes, pallets, large appliances, and water heaters.

In the last three years, Curri has rapidly grown to meet the overwhelming demand from our customers. The company expanded our services to cover all types of delivery options including hot shots, dedicated services, and freight, powered by a national fleet of vehicles ranging from sedans to box trucks and flatbeds. This venture also delivered complete transparency and the fastest delivery options in the industry. In this time Curri started serving customers beyond our hometown of Los Angeles, growing our network nationwide with a presence in every major U.S. city.

$93M | Series D | 5/31/2023

Investors: Co-led by Energy Impact Partners and Sway Ventures with participation from Moderne Ventures, WVV, Suffolk Construction, Broadscale, Camber Creek, Salesforce Ventures, Building Ventures, Constellation Technology Ventures, Concrete Ventures, RET Ventures, Colliers, and Lincoln Property Company

Measurabl is the world’s most widely adopted ESG (environmental, social, governance) solution for real estate. Customers use Measurabl to measure, manage, report, and act on ESG data on more than 15 billion square feet of commercial real estate across 92 countries. Measurabl empowers customers to optimize ESG performance, assess exposure to physical climate risk, drive decarbonization, and secure sustainable finance opportunities.

Want To Learn More About the Mission-Critical Tech & Investments Driving The Built World

Check out BuiltWorlds Venture Forum Offering For More

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.