As we approach the end of 2017 and look back on the last 12 months, it’s clear that it’s been a standout year for the AEC industry. From emerging technology to stunning venture rounds, 2017 has been loaded with dynamic built industry news. And we don’t want to keep you out of the loop.

To give you full perspective on what happened, we’ve gathered the 17 biggest industry stories from the year to provide you with business insights, important innovations, and industry trends so you and your team can stay ahead of the game. But it’s not just a list, with each article is an accompanying take on why it’s important to you, your company, and the industry as a whole.

January

EquipmentShare announces $26 million in funding

Thanks in part to the promise of their (now implemented) fleet management telematics solution ES Track, EquipmentShare announced their securing of $26 million in VC funding by Insight Venture Partners. This put the company at over $28 million in investments since their seed round (led by Y Combinator and Romulus Capital) in May, 2016.

BW Insight: Is EquipmentShare’s passive income solution what every construction company has been waiting for?

February

Autodesk CEO Carl Bass steps down

Outspoken Autodesk CEO Carl Bass steps down and denies rumors linking decision with disparaging remarks about President Trump. Bass explains that resignation was not made hastily, but had been in planning with the board for 18 months. Senior VP’s Andrew Anagnost and Amar Hanspal took over reigns as co-CEOs.

BW Insight: Autodesk’s stock price (ADSK) has risen about 25% since February, showing that investor confidence is high as this software giant remains flexible. Case in point: In their recent strategic shift to a subscription business.

Fifth Wall announces $212 million RE and Built tech fund - the largest fund in the history of the sector

Fifth Wall debuts strong as a $212 million venture fund whose eyes are set on real estate and built tech startups. In July they launched an early-stage accelerator program in an effort to attract their large corporate investors to promising, young tech startups. The company says it will be looking to make initial investments in the range of $500,000 to $1 million.

BW Insight: Historically, the built world’s tech sector has remained largely untouched by top tier generalist VC investors, making Fifth Wall’s splash feel that much more significant. But the past couple of years have really seen that all change, with many startups in the space receiving big money from big investors. Fifth Wall may not have started the trend of focus funds in the space, but they’re certainly helping to set the pace of investment.

April

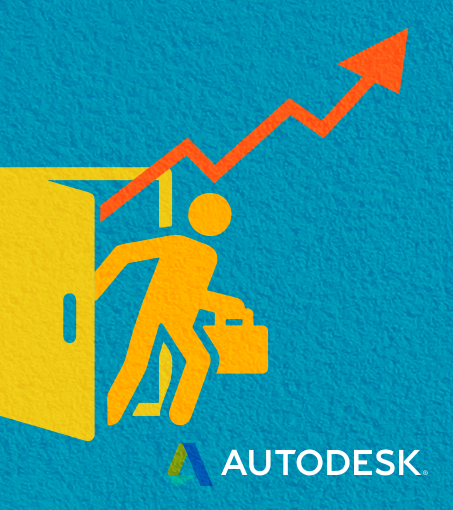

Katerra completes $130 million series C round

With a $1 billion valuation and another $130 million in funding, Katerra finished April in strong fashion and ready to rock the industry with their end-to-end development, design, and construction services. To date, the company has raised $220 million.

BW Insight: Katerra is betting heavily on mass timber construction and their rapid growth begs the question: are the buildings of the future made of wood?

May

Dewalt launches WiFi access points system

Dewalt announced a secure onsite mesh WiFi solution that will reliably support all the new tech finding its way onto the jobsite. And Dewalt isn’t done yet; they’ll be delivering an IoT platform in the first half of 2018 that will change the way construction sites operate.

BW Insight: They claim, based on data collected from a case study with Mortenson Construction, that the system will save a construction project 2 percent on labor costs. Also, did you feel that? Your jobsite productivity just advanced 20 years. The access point was also featured in our 2017 Gear Guide.

UL and ESD announce partnership to establish data certification program

In an effort to protect the built industry “in the event of a cloud services provider data center, infrastructure or network failure,” UL has selected ESD Consulting to help build a new international data certification program. The industry’s fast-growing reliance on cloud computing puts it at risk of widespread shutdown if such an issue were to occur. This new UL 3223 certification standard will hopefully be the preventative measure needed.

BW Insight: The pace of our industry’s tech growth is certainly encouraging, but so is the cry for objective standards in many areas, and collaborations like this may be what’s needed to assure the quality of our buildings as we grapple with a broadening field of technologies and objectives.

June

WeWork announces acquisition of Fieldlens

Fieldlens spent the 6 years since it was founded raising almost $13 million and providing the construction industry with a comprehensive mobile communication solution. One of its early adopters was the shared workspace giant, WeWork, and they liked being a Fieldlens customer so much they decided to acquire it. Since June, WeWork has announced their upcoming space operations management software, WeOS, which looks to be the Fieldlens 2.0.

BW Insight: As you know, WeWork is one of the fastest growing companies in the world and it’s huge to see them investing heavily in the built space. Their goal is to vertically integrate the entire process – meaning they design, own, and operate their spaces, so there’s definitely more acquisition potential to come from them.

After $200 million fundraising round, View reaches $650 million in total funding to date

You may not have heard of electrochromic glass, but if View has their way (and it looks like they are having it) you’ll be seeing a whole lot of it soon. Movement of lithium ions between two panes of smart glass allows these windows’ transparency to be adjusted, thereby saving on lighting and HVAC costs.

BW Insight: Overstock.com installed View Dynamic Glass windows in their new headquarters last year and CEO Patrick M. Byrne says it’s “one of the most effective investments we could have made.” This seems like a product with huge potential.

July

Modular high rise builder Full Stack Modular lands a series A

Full Stack Modular (FSM), an end-to-end RE design and manufacturing company, wrapped up an impressive $6 million series A round of funding. Claiming to shorten a building’s design-to-market by 30 - 50 percent, FSM is delivering a multitude of solutions to residential, hotel, and dormitory developers. Investors include McCourt Global, Lawrence Benenson, Lloyd Goldman, Jonathan Grunzweig, Jonathan Langer, and Daniel Levene.

BW Insight: While not in the eye popping size range of other funding rounds this year, the raise nonetheless signals new support for modular high rises, in contrast to the many low rise modular solutions on the market.

Hyperloop and The Boring Company are gaining speed

Hyperloop One has exciting news that it successfully completed a 70mph test at its Nevada test track. Since then, the ultra high-speed rail has achieved speeds exceeding 190mph. Elon Musk also announces, via Twitter, that his Boring Company has received “verbal govt approval” to build an underground Hyperloop route from New York to Washington DC.

BW Insight: I know you thought The Boring Company was one idea too many for Elon, but before you know it he may be digging under your feet. If they can figure it out, the disruption potential to the entire transportation industry here is unquestionably massive.

Caterpillar signs Memorandum of Understanding with Fastbrick Robotics

Fastbricks Robotics and Caterpillar Inc sign a 1-year term Memorandum of Understanding (MOU) to further develop their technology and strategize manufacturing, sales, and service plans for the product. The Hadrian X robotic bricklaying machine is an onsite robotic system which cuts cost, time, and waste from traditional methods.

BW Insight: It’s hard to deny the game-changer this technology will be, laying 1,000 bricks per hour without breaking any backs. Also, be on the lookout for significantly increased amounts of strategic investments like this from corporate giants in the coming years.

Viewpoint acquired Dexter + Chaney, striving to create “the strongest portfolio of ERP software in the industry”

Viewpoint’s industry-leading construction project operations software (Vista) is joining forces with Dexter + Chaney’s cloud-based ERP suite (Spectrum) to create a portfolio to rule them all. Dexter + Chaney was acquired in the deal, though their products will remain intact while being increasingly integrated with Viewpoint’s software.

BW Insight: This is the kind of supergroup innovation strategy that could revolutionize built industry operations by bringing efficiency to a new level.

September

KP Reddy announces the launch of Shadow Ventures

Shadow Ventures debuts its $25 million fund that will focus on seeding BuiltTech enterprises. This venture fund has its sensors tuned to innovations in industrial IoT, BIM, machine learning, and cloud/mobility. Keep an eye on where they choose to invest. Reddy has already made a splash in the built word by launching The Combine, an industry leading built environment incubator.

BW Insight: One of the key differentiators for Shadow, as opposed to a larger Fifth Wall, is its preference to stay relatively “small” and exclusively focused on AEC investments. To us, it’s a strong signal of more investment interest in the space. We expect to see more focus funds like Shadow to spring up.

October

Rhumbix announces raise of $7.3 million in a round led by Blackthorn Ventures

Rhumbix is helping to improve construction workflow via their cloud-based task management software and got support from Blackthorn Ventures, who led their $7.3 million funding round. It was the third series A round for the young company, who has reportedly raised a total of $20.6 million to date.

BW Insight: Rhumbix claims to be the only “construction-specific digital timekeeping solution,” and could be your easy solution to bringing your profitability to a new level.

Sidewalk Labs announces $50 million commitment to smart city in Toronto

Alphabet’s Sidewalk Labs is putting forth $50 million toward a projected $1 billion smart city development project along Toronto’s waterfront. They’ll start with demonstrating proof of concept on a 12-acre piece of waterfront, called Quayside, and then expand to an 800-acre area that will become a mixed-use neighborhood with sensor-driven solutions to things like public transportation.

BW Insight: This will be the largest smart city project Google has ever been involved with and, if we know anything about Google, could be a giant lab for BuiltTech innovation.

Suffolk Construction announces the first of its series of Smart Labs

Innovative building leader, Suffolk, launches its first Smart Lab in New York City. The facility is equipped with a Virtual Reality CAVE, predictive data analytics, live jobsite streaming and time-lapses, and several other shared-experience tech that will attempt to revolutionize the way the construction industry operates internally as well as with clients. An LA Smart Lab is slated to open in 2018, as well as locations in Miami, San Francisco, Tampa, and Boston.

BW Insight: Tech companies in other industries realized long ago that supporting internal startups empowers employees and encourages collaboration. These Smart Labs are applying that theory to construction and should see some exciting results.

December

Oracle acquires Aconex for $1.19 billion

In its largest acquisition of 2017, Oracle announces that it is buying SaaS construction management software company Aconex for a whopping $1.19 billion. This was almost a 50 percent premium to Aconex’s closing price the day prior.

BW Insight: This deal further solidifies that the battle for top cloud management software is in full force and the playing field is packed with heavy hitters.