Dr. Burcin Kaplanoglu, vice president and operations director of telecommunication infrastructure at Lendlease, and Zach Scheel, co-founder and CEO of Rhumbix, are regular BuiltWorlds contributors.

We invite experts and thought leaders to share their knowledge on topics related to innovation in the built environment. Information on each contributor can be found at the bottom of each article. Learn more about our contributor program here.

We invite experts and thought leaders to share their knowledge on topics related to innovation in the built environment. Information on each contributor can be found at the bottom of each article. Learn more about our contributor program here.

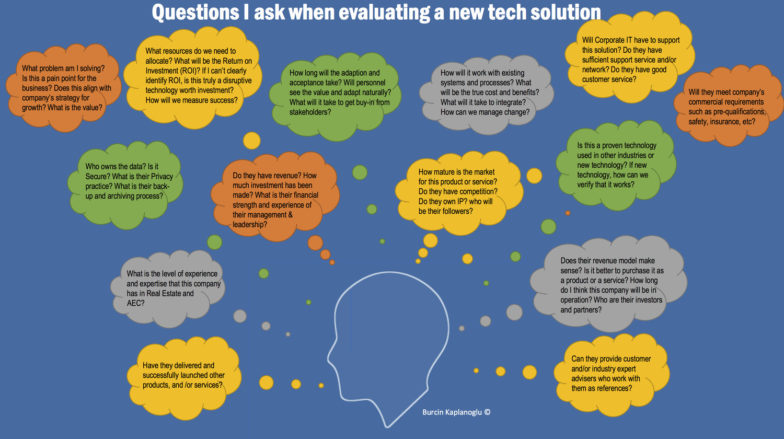

Burcin: I published an article on evaluating architecture, engineering, construction, and real estate (AEC/RE) technologies and shared the questions I ask from the customer’s point of view. In it, I challenged the way the companies work internally and with others to form partnerships and highlighted the need to find new ways to do business. Based on the feedback I got from readers, I wanted to approach the same question from a technology company’s point of view. I asked Zach if he would co-author a piece with me, and he kindly accepted.

The technology sales cycle in an AEC/RE company can be a slow and painful process. The best way to avoid getting stuck in an infinite loop of gaining buy-in from a seemingly endless list of stakeholders is by not being afraid to ask tough questions at the beginning of the sales process. When a technology company asks these questions up-front, it demonstrates a deeper understanding of the buyer’s journey and helps identify potential roadblocks earlier in the sales cycle.

The following list of five questions helps establish a clear path from pilot through purchase and aligns expectations for both the technology vendor and the AEC/RE company. These five questions are relevant to all industries in which technology vendors sell, but their importance increases significantly due to some unique characteristics of AEC/RE such as:

- project based nature,

- lack of integrated platforms,

- low spend on IT (less than 2 percent of operating budgets),

- very large and fragmented market ($1.1 trillion USD market, and ENR’s Top 400 Contractors annually only represent about 30 percent in combined revenues),

- front-end risks of early adoption and difficulties identifying consistent returns on investment (ROI) where market performance is cyclical,

- and its well-known resistance to change.

#1: How do you innovate?

One of the first things to understand about your prospective customer is how they innovate. Most companies do so bottom-up or top-down.

+ Top-down model

New technology solutions are decided at the corporate level, where decisions are made by either the C-suite or a technology committee. The technology selection process typically begins with a list of strategic priorities for the company to address (e.g. purchase a new accounting/ERP system, get rid of paper time cards, etc.).

Next, an individual or the technology committee is tasked with evaluating solutions, getting stakeholder buy-in, and making a recommendation. This involves numerous decision-makers at the project and corporate level, screening multiple vendors, and building a business case for each of the solutions. This process does not have a straightforward path, often requires buy-in from various departments within the company, and doesn’t always have a finite timeline for making the purchase decision.

A top-down model is more challenging for startups because they are often compared against legacy providers, which is not an apples-to-apples comparison — of course legacy incumbents have more features or functionality!

Sales cycles are much longer in top-down organizations, but on the flipside, you only have to sell the company once, not for each project.

+ Bottom-up model

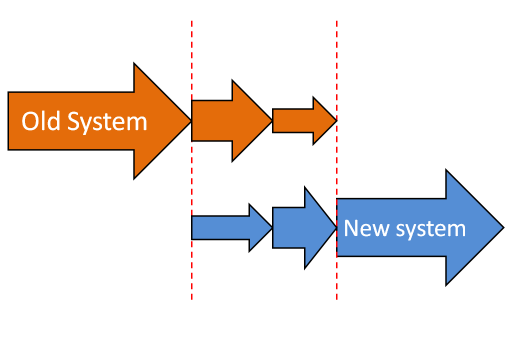

Decision making is decentralized, and project teams are empowered to find solutions for their pain points. In this model, project teams can quickly deploy pilots and proof-of-concept deployments, and the best solutions are subsequently scaled to additional projects throughout the company.

The benefit is a quicker time-to-pilot, but due to complex corporate governance structures, it can take months or years to go through all the internal approval processes required before a company-wide software agreement is signed.

Corporations want to eliminate having multiple systems with overlapping functionality across projects because it increases the cost to support, maintain, and provide training across those platforms. As such, it can be very difficult for software vendors to make the jump from project-level deployments to corporate-wide purchases.

Neither of these models are ideal since there needs to be balance between strict governance and fast deployment. We recommend that technology vendors identify the deployment model that is best-suited for their product and ensure the go-to-market strategy is aligned with how the company innovates.

#2: How will the technology solution be funded?

In the AEC industry, where less than 2 percent of a corporation’s operating budget is spent on IT, multiple stakeholders constantly fight over the small sliver of available budget. Because of this, it’s critically important to establish early in the sales process how the technology solution will be funded.

Companies might fund deployment of new technology solutions at the project level and/or corporate level, depending on their organizational structure (e.g. top-down vs. bottom-up) and company culture (more on this below). In the past couple of years, AEC/RE firms have begun allocating specific innovation funds to pilot new technologies. These innovation budgets have made it significantly easier to fund new pilots, however, most AEC/RE companies have yet to establish a process for how a new technology goes from pilot to enterprise-wide purchase. When technology companies raise this question early in the sales cycle, it helps clarifying the path and minimize roadblocks.

#3: Who is the solution sponsor? Who are the other influencers?

In addition to learning how the technology solution will be funded, it’s important to identify the other personas that will impact the decision of whether a company purchases the technology, including:

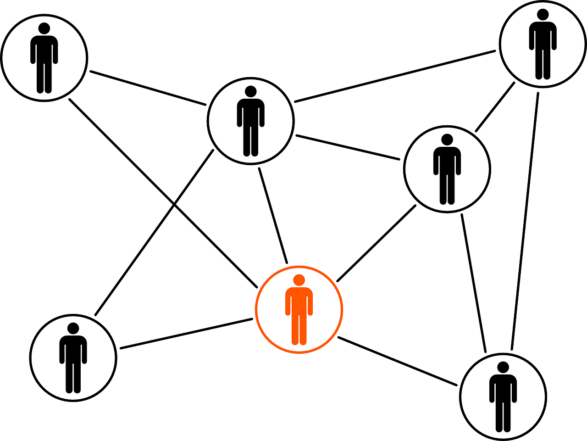

- Champion: The Champion is the person who will sponsor your proposal and go to bat for you inside the buying company. This person should have budget, authority, need, and timeline (BANT) to find a technology to help solve a pain point or work towards a strategic goal for the company.

- Influencers: Influencers are found throughout companies and can range from direct users of the technology, to a tech committee, to the company’s CFO, CISO, CIO, or legal department. The list of influencers is all the people who will have input on the purchase decision, and you can have both positive and negative influencers.

It’s important to identify your Champion early in the sales process and work with that individual to create a list of all the Influencers who will be involved in the buying process. Depending on the size of the AEC/RE company, this list can be very short, but at larger companies it will often involve stakeholders across many different departments and geographies within the firm.

It is critical to have supportive Influencers at multiple levels of the corporation — their levels of authority/power/sway will play a large role in the final purchase decision. Therefore, it’s important to identify your Champion and Influencers early in the process and to work with them to build the necessary business cases and marketing collateral to gain buy-in from the other key influencers within the organization.

#4: How will the solution be implemented?

Will there be sufficient resources for the pilot and enterprise deployment? Corporations struggle to allocate sufficient time and resources for piloting new technologies. This is always a challenge because most pilots are run through project-level funding; even the ones funded at the corporate level are challenged by the project team’s time commitments.

Project teams never have enough hours in the day to do all the work they have on their plates, so unless the technology has a clear path to delivering value to the project team, it will be difficult for them to dedicate the time and energy necessary to ensuring success of the pilot.

Before kicking off a pilot, it’s important to clearly outline expectations for the pilot and agree on how success will be measured. If you are looking for further information, some of the lessons learned about launching successful pilots captured in this recent blog post.

After a successful pilot or proof-of-concept demonstration of the technology, the next phase of expansion requires dedicated resources from the AEC firm. It’s important to identify the person or team who will be responsible for implementation of your solution across projects and regions at the company. This person or team is typically not your Champion.

Your Champion will have helped you navigate the process through successful pilot and purchase of your technology. However, after the contract is signed, the implementation is typically handed off to another individual or team. These people typically come from IT departments, BIM/VDC departments, or a technology/project solutions group.

A common mistake we see is for AEC firms to assume that because they’re moving to the cloud and SaaS vendors, that they are no longer responsible for implementation of the tech solution. In fact, the opposite is true.

We’ve found that the most technology-forward construction companies have an established internal process and dedicated team for how they scale new technologies from pilot through company-wide deployment. These resources are typically funded at the corporate level, not from the project budgets. Cloud and SaaS vendors reduce the in-house resources required for maintenance and upkeep of the technology, but it’s still important to dedicate resources for managing implementation of the new technology at the corporate level.

#5: Does the company culture embrace innovation and new technology?

The AEC has been getting a lot attention lately for its slow adoption of technologies, decreasing productivity levels, and low levels of digitization. Outsiders are looking at the scale of our industry and its potential, and they are now trying to enter into AEC to disrupt it.

If a corporation is risk averse, trying new technologies that could result in failure might be the biggest obstacle. That’s why, as technology companies get engaged with the corporations, it’s important to understand their culture and address these issues head on.

AEC firms might have funding allocated, a strong internal Champion, buy-in from Influencers, and staffed-resources, but if the company culture does not embrace risk-taking and early-adoption of new technologies, then success is far from guaranteed for the technology vendor.

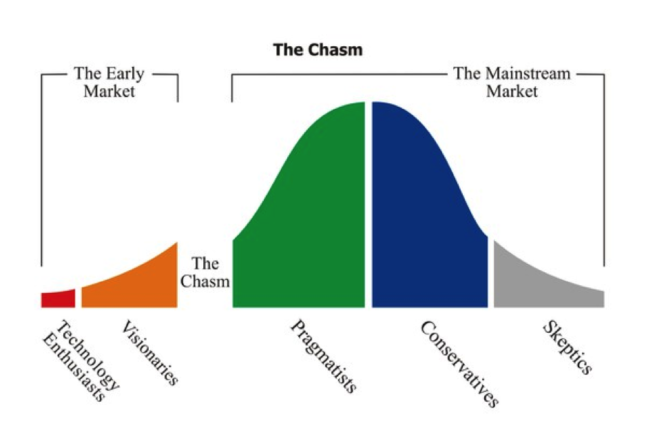

Geoffrey Moore’s book, Crossing the Chasm, was originally published in 1991, but its framework for how to market and sell new technologies is still relevant today.

For technology vendors, the maturity of your product will dictate who you can sell it to and how you should sell it. For startups at the earliest stages of product-market fit, it’s imperative to focus efforts on identifying and selling into The Early Market, comprised of visionaries and technology enthusiasts.

Selling to the mainstream market requires a more mature product and calls for different sales and marketing strategies. We recommend that technology vendors familiarize themselves with Moore’s Technology Adoption Life Cycle and match their product with the appropriate market segments.

Once a technology company understands and addresses the key questions above, both parties will have a clear roadmap and mutual understanding of what to expect from the initial pilot, through purchase and project expansion. At that point, all that remains are negotiating commercial terms and executing the agreement.

However, the work doesn’t stop after the deal is signed. We encourage all technology companies to remain very hands-on with the corporation and its partners post-purchase to ensure the product is meeting the needs of the customer and delivering value. This allows for continuous feedback to improve products and services provided by the technology company and helps ensure the highest levels of customer satisfaction.

AEC/RE technology companies that provide the best customer experiences enable creation of evangelical users who will be long-term customers. They will gain the benefits of free marketing within user’s network — a true win-win for both the customer and the technology company.

About the Authors

Based in Chicago, Burcin Kaplanoglu is a recognized industry technologist and thought leader who advises start-ups, speaks at industry events, and serves as adjunct faculty at Northwestern University. By day, he is vice president and operations director of telecommunication infrastructure at Lendlease. In addition to IoT, he writes about other tech solutions—including drones, wearables, robotics, and predictive analytics—and their applications to real estate and the AEC space.

Based in Chicago, Burcin Kaplanoglu is a recognized industry technologist and thought leader who advises start-ups, speaks at industry events, and serves as adjunct faculty at Northwestern University. By day, he is vice president and operations director of telecommunication infrastructure at Lendlease. In addition to IoT, he writes about other tech solutions—including drones, wearables, robotics, and predictive analytics—and their applications to real estate and the AEC space.

Burcin’s note: I write this blog solely in a personal capacity. The views expressed above are mine alone and do not represent the official views of my employer, any clients, companies, universities, institutions, or groups with which I may be affiliated. Also, the mention of a firm or use of its logo should not be construed as an endorsement of that company or its products. —BK

Zach Scheel is the co-founder and CEO of Rhumbix. After completing his undergraduate studies at Duke University, Zach served for five years as a Civil Engineer Corps Officer in the US Navy. His billets included serving as the Resident Officer in Charge of Construction and Assistant Public Works Officer at Naval Station Everett, WA, and Military Construction Manager at Camp Lemonnier, Djibouti. After his military service, Zach worked as an Associate at Bechtel Enterprises, Assistant Area Superintendent at Ivanpah Solar Electric Generating System, and as a Project Controls Engineer at Organic Growth Project One, located in the Atacama Desert of Northern Chile.

Zach Scheel is the co-founder and CEO of Rhumbix. After completing his undergraduate studies at Duke University, Zach served for five years as a Civil Engineer Corps Officer in the US Navy. His billets included serving as the Resident Officer in Charge of Construction and Assistant Public Works Officer at Naval Station Everett, WA, and Military Construction Manager at Camp Lemonnier, Djibouti. After his military service, Zach worked as an Associate at Bechtel Enterprises, Assistant Area Superintendent at Ivanpah Solar Electric Generating System, and as a Project Controls Engineer at Organic Growth Project One, located in the Atacama Desert of Northern Chile.

Zach holds dual master’s degrees from Stanford University in business and construction, is a registered professional engineer in the state of California, and a LEED Accredited Professional (BD+C). Zach serves as an Advisor to the Movember Foundation and is actively involved in numerous Veteran-related charities. Outside of work, Zach’s hobbies include surfing, skiing, wakeboarding, travel, and mountaineering.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.